Risks are inherent in trading, and how to limit them is one of the first things that traders should think about. The same should be said about a trading platform that wants its users to remain for the long term. Trading limits are one instrument that Olymp Trade uses to keep its traders from losing money.

What Are Trading Limits

First things first, let’s talk about what trading limits are, exactly. Trading limits are an instrument that we use when the situation on the market is too unpredictable for both us and liquidity providers to forecast. That means that your deals can have a far too unpredictable result, possibly bringing heavy losses.

In order to avoid that, our risk management system limits the amount of investment that you can use to open a position, for a certain period of time until the market stabilizes. This way, your money is safeguarded while we are waiting out this turbulence.

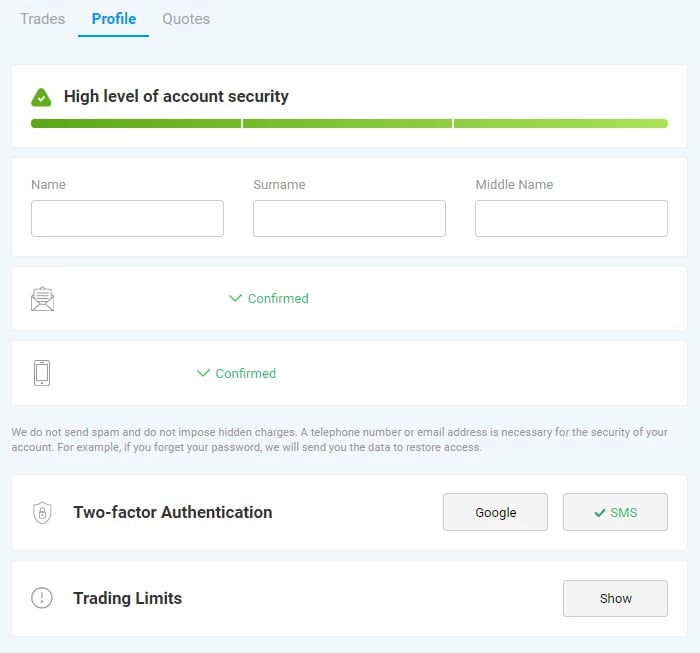

You can find out if you have limits in your trader account, under the Profile tab, or in the Profile section in the Olymp Trade mobile app.

How Are They Used

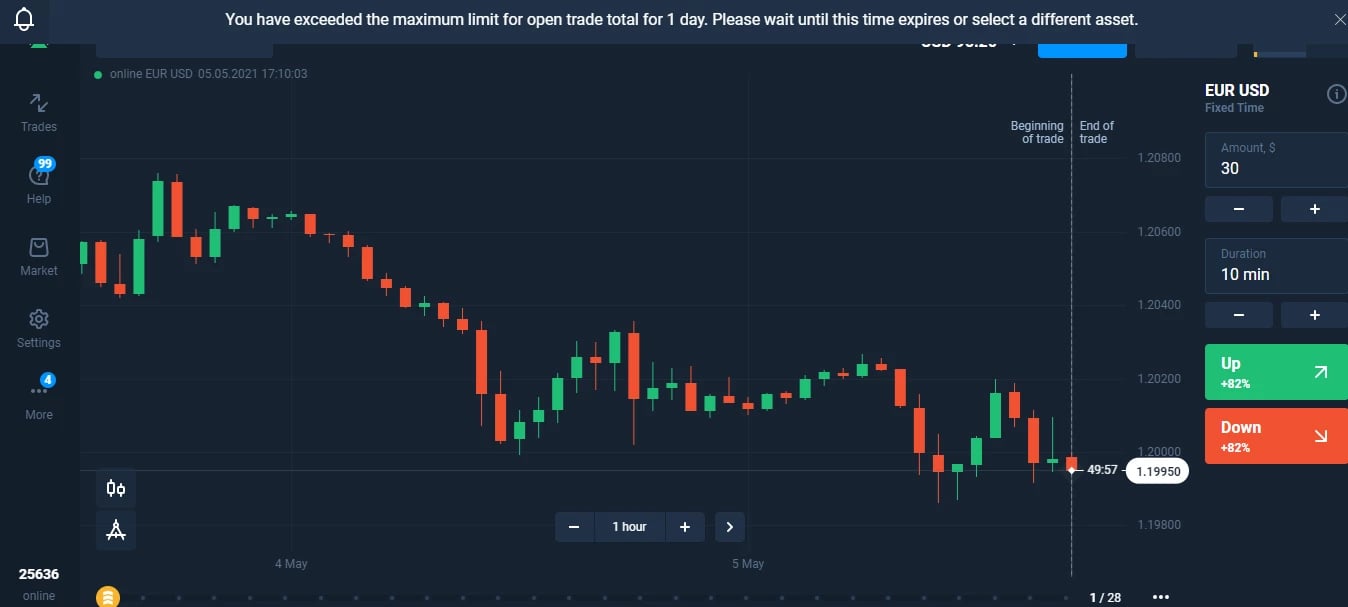

When the limit is set for your account, you’ll be informed via an impossible-to-miss pop-up message, so you’ll know if that ever happens.

There are few different ways that limits might be implemented for your account:

- On the account as a whole — you won’t be able to trade above a certain volume threshold from this account until it is lifted;

- On a certain asset or group of assets — for example, you won’t be able to open trades with a volume exceeding this instrument’s limit;

- On a certain type of trade — for example, you will be able to only close already existing trades but not open new ones;

- On a trading volume — this way, you are free to trade any asset, but you can’t open a deal over a certain threshold.

As you can see, all ways are pretty straightforward, and we can react to many market situations with them while not stifling your trading.

How to Cancel a Limit

Sadly, you can’t manually turn limits off once they are in place. Our risk management algorithms do that after a certain time (usually after 24 hours). However, there are ways to make our risk management system reduce it or even cancel it altogether:

- Complete your KYC — verify your account;

- Change your preferred trade duration;

- Trade different assets for a while;

- Reduce the investment amount;

- Make a deposit and/or decline bonus money;

Also, keep in mind that most limits on our platform don’t exceed 24 hours, even though in some rare cases they might last for a few days.

How to Avoid Limits

Even though markets are sometimes unpredictable, there are a few rules that you can follow to avoid trading limits on your account:

- Verify your account;

- Make smaller trades, proportional to your overall balance;

- Don’t abuse our bonus programs;

- Avoid creating multiple trading profiles, especially since you can now create multiple accounts under one profile.

As you can see, those are fairly simple and easy-to-follow rules. By following these, you can minimize your risks while trading and avoid our risk management system limiting you.

We hope that this article has answered your most pressing question about Olymp Trade trading limits, why they exist, and how they work. Keep going strong, and don’t hesitate to ask us more questions if you have them.