Whether you are already investing in the Forex markets with Olymp Trade or you’re looking to start, there are many things to consider and understand in order to find more success in your trades. While Forex trading with currency pairs may appear to be overly complex, and it is to some extent, traders can employ a number of different methods to improve their trading results.

Each factor that affects currency trading can be extremely complex, but not all these complexities need to be explored too deeply. However, getting a good foreign exchange market overview and a good understanding will suffice in helping to make better trading decisions.

Here are some of the things traders should consider when investing in Forex markets that are broken down in simpler terms to help average investors.

1. How Interest Rates Affect Currency Value

Nearly every country has interest rates that are set by a “central bank” in that country. In the United States, that authority resides with the U.S. Federal Reserve Bank, and the names of each institution varies, but they essentially do the same thing, which is to determine the national interest rate.

This interest rate IS NOT the rate that banks charge customers to borrow money for homes, cars, or to start/fund businesses. Instead, this is the interest rate that banks charge each other for loans to each other. Yes, banks borrow money from each other constantly to meet other federal requirements, but that is for another time.

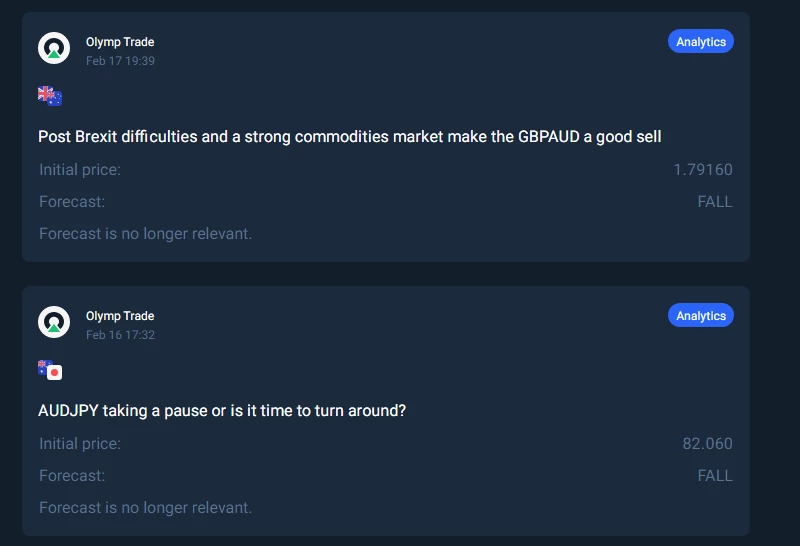

Higher interest rates help to reduce inflation while lower rates help to increase business activity. Any news released about interest rates will often affect forex and stock markets and changes to an interest rate will directly affect that country’s currency value. You can find many news updates with Olymp Trade’s Insights section of the platform like those in the image below, but combining news sources is usually best.

2. How the General Economic Health Affects Currencies

The strength of a country’s economy will have a big impact on how that country’s currency is valued against other currencies. A country with a solid or growing economy has the ability to buy more goods and services and puts more of its money into circulation. This, in turn, will affect how it’s currency is valued.

There are several monthly, quarterly, and yearly reports that will indicate how well a country’s economy is performing. The most important of these reports is Gross Domestic Product (GDP) and traders are advised to pay attention to any news on the growth of GDP in major countries like the U.S., China, and the EU.

Additionally, unemployment figures, consumer confidence, and inflation reports can affect the forex markets directly.

3. Be Aware of Political Turmoil and Military Conflict

Political and military upheaval in any country or region can have a significant impact on other countries and regions that don’t appear to have any direct relationship to the conflict. However, we live in a global economy and the world gets smaller and more connected by the day.

Keep an eye out for news on the political situations at the top levels and of any brewing military conflicts and actively ask questions and seek answers as to how these things might affect trade in the world.

For example, political turmoil in a small country like Myanmar could have an impact on trade with China since Myanmar is a net exporter of natural gas to China. Any increased energy costs to Chinese manufacturers could raise market prices and lower profitability for others. As you can imagine, even some small ripples can create some economic waves.

4. Combine Fundamental and Technical Analysis

Some newer traders might be asking “what is market analysis” and “what is the difference between fundamental and technical analysis”. Rest assured, neither is too complicated or hard to understand with some time and practice and both are used in overall currency market analysis (forex).

Fundamental analysis is based more on economic and political news illustrated in the first 3 points. Whereas, technical analysis requires the evaluation of the actual trading charts for currency pairs.

A good strategy is to identify one or a few different currency pairs and become very familiar with them over time. You will be able to see patterns of behavior based on economic news as well as how these pairs trend and reverse their trends.

For example, the EUR/USD pair is the most traded forex asset. It will be sensitive to U.S. and European economic data such as interest rate changes, unemployment, and GDP. However, technical analysis shows that since 2015 it will almost always trade above an exchange rate of 1.1 (1 euro is equal to 1.1 USD).

Here is a 1 month chart of the pair with the pink horizontal line showing the tremendous support at the 1.1 level. Understanding the historical behavior of the pair will be useful if/when it nears the 1.1 level in the future in respect to how to make a trading decision based on news.

You can improve your skills on how to conduct technical analysis of the market on the platform by taking advantage of the many tutorials and make much better decisions on when to enter and exit positions on the market. What is more, if traders implement many of the forex trading strategies which can be learned on the platform, they will be able to maximize their profitability.

Become an Expert Using These Principles

Traders don’t need to have a degree in Finance or economics to become an expert on forex and understand how to analyze the markets. All the information needed is available for free and in greater detail than what has been explained above.

By keeping the ideas discussed here in mind while trading will improve your trading behavior on its own since your awareness will impact your market analysis and decision making. However, taking the extra time to hone your analytical skills and apply it when you see relevant information in the news or elsewhere, will certainly increase your trading success rate.

Keep in mind, if your fundamental and technical analysis provides you one more profitable trade of $100 a week, you will have made another $5,000 dollars after a year. The reward is definitely worth the effort.