Stock trading can rightly be considered not only an opportunity to enrich one’s life, but also a form of financial art. Do you want to become a part of the stock market and make money? If so, you need to familiarize yourself with some fundamental aspects before you start.

Contents:

- Things you should know before trading stocks

- Factors that influence stock price

- The influence of external events on stock prices

- Trading stocks effortlessly

Interact with the underlined words and green dots to get additional details and explanations.

Additional context for the visuals.

Explanations and definitions of terms.

Things you should know before trading stocks

Before you start trading on the stock market, you need to set clear limits relative to your ability. You can’t run a marathon without first knowing how to walk, right? Let’s take a look at some vital points you should know before trading on the stock market.

1️⃣ Skill level and preparation

If you have no experience in stock trading, then the best way to take your first steps in this direction is by using the Olymp Trade demo account. Combining risk-free trading on a demo account with the study of our free materials will allow you to quickly master stock trading. You’ll get 10,000 free demo units, so you can test out your strategies and try new ones before entering the live waters.

2️⃣ Define your investment strategy

Before you decide on which stocks to buy, make sure to determine your goals and preferences. If your investment strategy involves speculative stock trading, then the FTT and Forex modes are for you. If you want to trade stocks as an investor, then Olymp Trade’s Stocks mode is the best choice for you.

3️⃣ Set time limits

How does speculative trading differ from investment trading? Traders who trade stocks quickly are speculators, while those who buy assets to hold for the long term are investors. You’ll first need to decide whether you are more interested in investing or speculating, then determine the investment time horizon for yourself on each asset you want to trade.

It’s important to understand that, along with quick profits, speculators bear a proportionate level of risk, while investors see a smaller but more stable margin of profit and fewer risks. Something that successful investors and speculators have in common, though, is an understanding of market trends. A competent analysis of market trends (made easier with the use of oscillators like Aroon and StochRSI) will help reduce the level of risk.

4️⃣ Conduct stock market analysis

For analyzing the stock market, traders conduct technical and fundamental analyses before they make any investment decisions.

Fundamental analysis is used to evaluate the sectors of the economy in which we plan to trade. This method helps identify promising industries and, when read right, gives some indication as to how to benefit from them. On the other hand, we can see general trends and volatility in the stock market through technical analysis. By following trends and analyzing stock performance, you’ll be able to get the most profit from your financial decisions. It’s important to not be too shy about testing the results of your analyses, as it’s the only way to improve your trading skills.

Learn more about fundamental and technical analysis in this article on Olymp Trade Blog, where we compare and contrast both. Meanwhile, the most up-to-date analytical information on the stock market is up on Olymp Trade Insights.

Factors that influence stock price

Stock prices are influenced by multiple factors. These factors have an impact on each company’s business and determine its future financial success. From this point of view, the following topics are key.

📊 Company analysis

We strongly recommend studying a company closely before deciding to buy its stock. The following points should be researched and/or known when making price predictions and before purchasing any company’s stock:

- Financial history. How has the company performed over the years?

- Economic indicators. How profitable is the company at the moment?

- Industry. In which industry does the company operate and what are its dynamics?

- Geography and macroeconomics. In which countries does the company have a presence, and to which countries does it supply its products?

- Corporate strategy. Is the company’s strategy to pay most of its net income as dividends (dividend stock), or to reinvest that net income in the business, helping it to further flourish (growth stocks)?

- Key product. How unique is the company’s offer in the market?

Before you invest even one dollar into a company, make sure you have analyzed its past and present states inside and out — enough that you could give a small presentation on it if asked.

📈 Financial reports

Publicly released by companies themselves, financial reports reflect the financial stability of a business or any possible issues it may be experiencing. Companies are legally obliged to declare all its financials — for better or for worse — in its annual reports and quarterly reports, so if a company’s financials show a consistent increase in costs along with dwindling profit, this is an alarming sign that can scare off some investors. For example, in October 2020, Mastercard showed a decline in financial performance in its third-quarter report. In one day, the company’s shares fell by 6%, and by the end of October, by 14.65%.

While keeping an eye on a company’s reporting may be the best way to understand how well it’s doing economically, there’s another pillar to keep in mind.

📢 Сompany news

Share price and stock performance depend not only on the financial data reported by a company. Political and economic affairs around the world can cause powerful fluctuations in the global financial market. If something important and unexpected occurs, the stock markets respond by going either up or down, depending on the nature of the news. Company decisions and projects can also influence the price action of stocks.

For example, in 2019, Google announced its Stadia platform for cloud gaming. Thanks to this news,

AMD’s stock price (Google’s main supplier for the new platform) rose by 12% in one day.

Before reaching for success, companies set themselves goals and voice them to the world. This may seem paradoxical, but it plays an important role in the rise or fall of a company’s share price.

🤔 Forecasts

A stock’s value is based not only on its company’s past or current performance, but also on expectations of future performance. Stock prices often react more strongly to a forecast than they do to earnings from previous and current quarters.

For example, Morgan Stanley analyst Joseph Moore publicly expressed his expectations for strong financial results from AMD in 2020 due to the company’s positive growth drivers. On the back of this news, the share price of the microchip manufacturer rose by 8%.

The influence of external events on stock prices

Successful investors and traders are constantly monitoring what is happening across the globe, because they understand that the world outside has an influence on stock prices. Some news is more important than others when building an investment strategy, however, and in this case it’s the financial, economic and geopolitical news that take precedence when influencing stock prices.

👥 Social media

The influence of social media and online forums on financial markets is growing. People gather to discuss company stocks, and can lead online movements to create artificial hype around individual assets. Some opinion leaders rally masses of users around themselves, which gives them the power to make an avalanche-like trend in the stock market.

Let’s take a simple example. At the beginning of April 2022, Elon Musk acquired a 9.2% stake in Twitter, becoming one of its largest shareholders and promising to buy out the social network. Twitter shares reacted to this news with rapid growth. However, Musk later backed out of the deal, dropping Twitter shares by 7%.

🌍 World news

World news can have a significant impact not only on individual stocks but on the entire market. Anything can spark a price change — political events, natural disasters or a pandemic. When the US decided to limit exports of Nvidia chips, for example, the video card manufacturer’s stock collapsed by 6.63%.

While global news can bring downfalls for some stocks, it can bring growth for others. The transport, financial and real estate sectors suffered the most during the COVID-19 pandemic, but the lockdowns and resulting preference to stay at home has caused a wave of people transitioning to remote work facilitated by digital technology, and the tech sector has seen massive growth as a direct result. In addition, pharmaceutical stocks rose as people waited for vaccines to arrive and became more conscious of personal health and hygiene.

Therefore, it is important to analyze not only local news, but also focus on the global events happening around the world. Follow the news regularly and try to understand how an event can change behavior and spending habits.

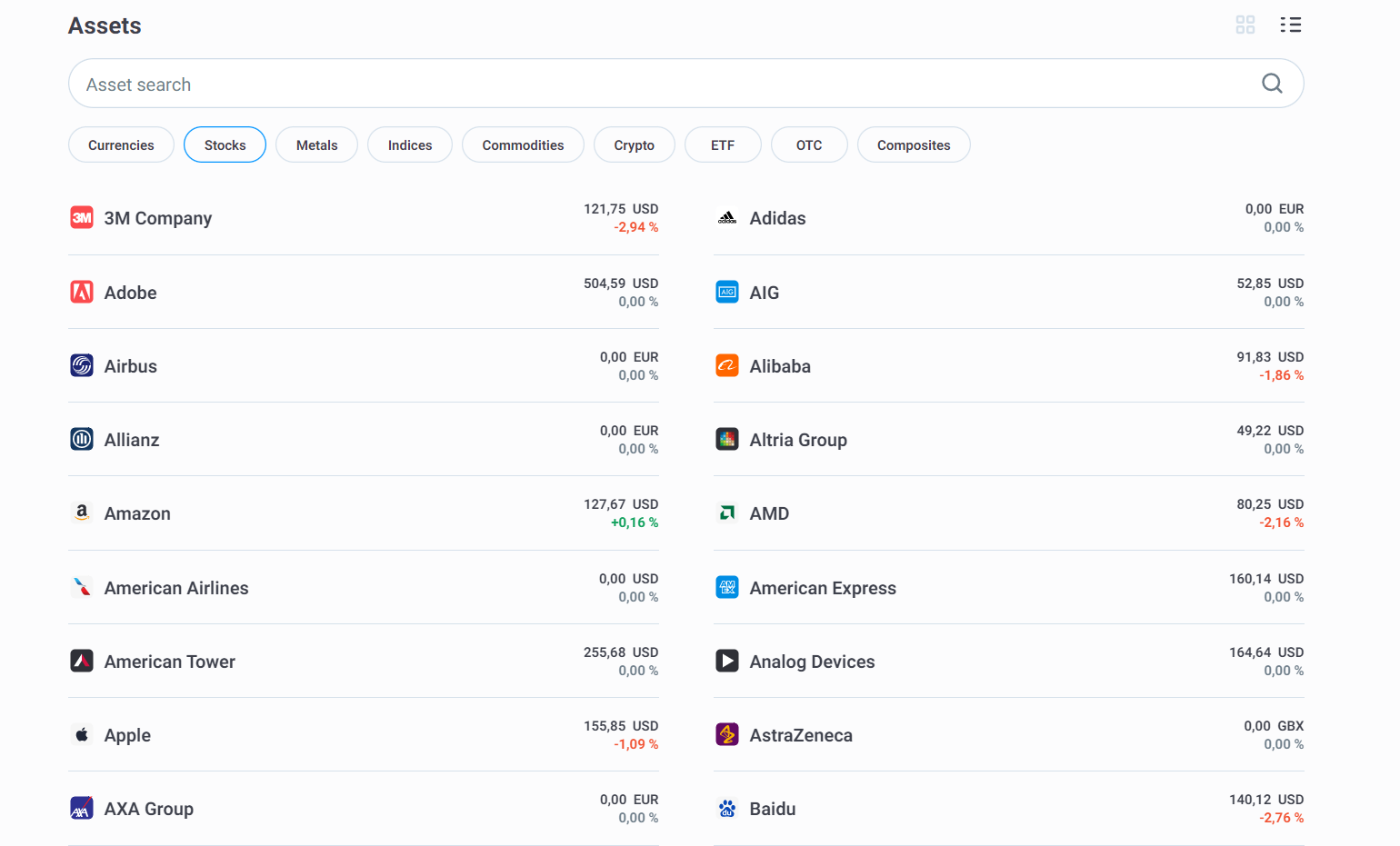

Trading stocks effortlessly

Choosing the right stocks to buy and successfully trading them is like an art form. When keeping in mind the aspects that are vital to making financial decisions, you prepare yourself for the unexpected and create conditions that are conducive to financial success, regardless of the investment time horizon you have chosen. When you are ready to trade, over 170 of the world’s most popular stocks will be waiting for you on Olymp Trade.

One of the fundamental principles of Olymp Trade is providing free education to its traders. We love to share all the intricacies of the financial world, because your success is our success. Join our growing Olymp Trade community and trade with us, learn from others, and become a force to be reckoned with on the markets.

Go to Olymp TradeRisk warning: The contents of this article do not constitute investment advice, and you bear sole responsibility for your trading activity and/or trading results.

Fixed Time Trades mode is one of the trading modes available on Olymp Trade. In this mode, you make trades for a limited period of time and receive a fixed rate of return for a correct forecast about movements in currency, stock and other asset prices.

The period of time that an investor intends to hold an asset in order to reach a specific goal.

A stock whose company regularly pays out some of its profit to investors in the form of dividends.

A company stock with significant potential for price growth in the future.

A way to access and play computer games using remote servers and hardware.