The main goal that any trader sets for himself when investing in assets in the stock market is to make a profit. The probability that events deviate from the average expected outcome is commonly referred to as risk. To reduce losses and increase the profitability of investments, you must know how to minimize risks in the stock market.

You will then need to decide on your long-term strategy and preferences. The rules of trading and the level of risk depending on your choice. If you want to trade stocks for the long term, then Stocks mode on the platform is your best choice. We will refer to this type of trader as an “investor”.

If you are looking to earn on short-term market fluctuations, then FTT and Forex mode is a better choice. We will refer to this type of trader as a “speculator”.

Contents:

- Risk Management Rules for Investors

- Risk Management Rules for Traders

- General rules of Risk Management

- Risk Management is a Your Companion

Interact with the underlined words and green dots to get additional details and explanations.

Additional context for the visuals.

Explanations and definitions of terms.

Risk Management Rules for Investors

Depending on your trading style and plans, there are risk management rules. If you are an investor, the following recommendations to avoid stock market risk will be relevant.

Fundamental Analysis 📰

If you are an investor and plan to buy stocks long-term, then studying fundamental analysis will allow you to determine whether a stock is undervalued or overvalued and decide whether to buy or sell it.

For example, if the intrinsic value of a stock is higher than the current market price, the stock is considered undervalued. It is recommended to buy. If the intrinsic value of a stock is below the market price, it is considered overvalued. It is recommended to sell.

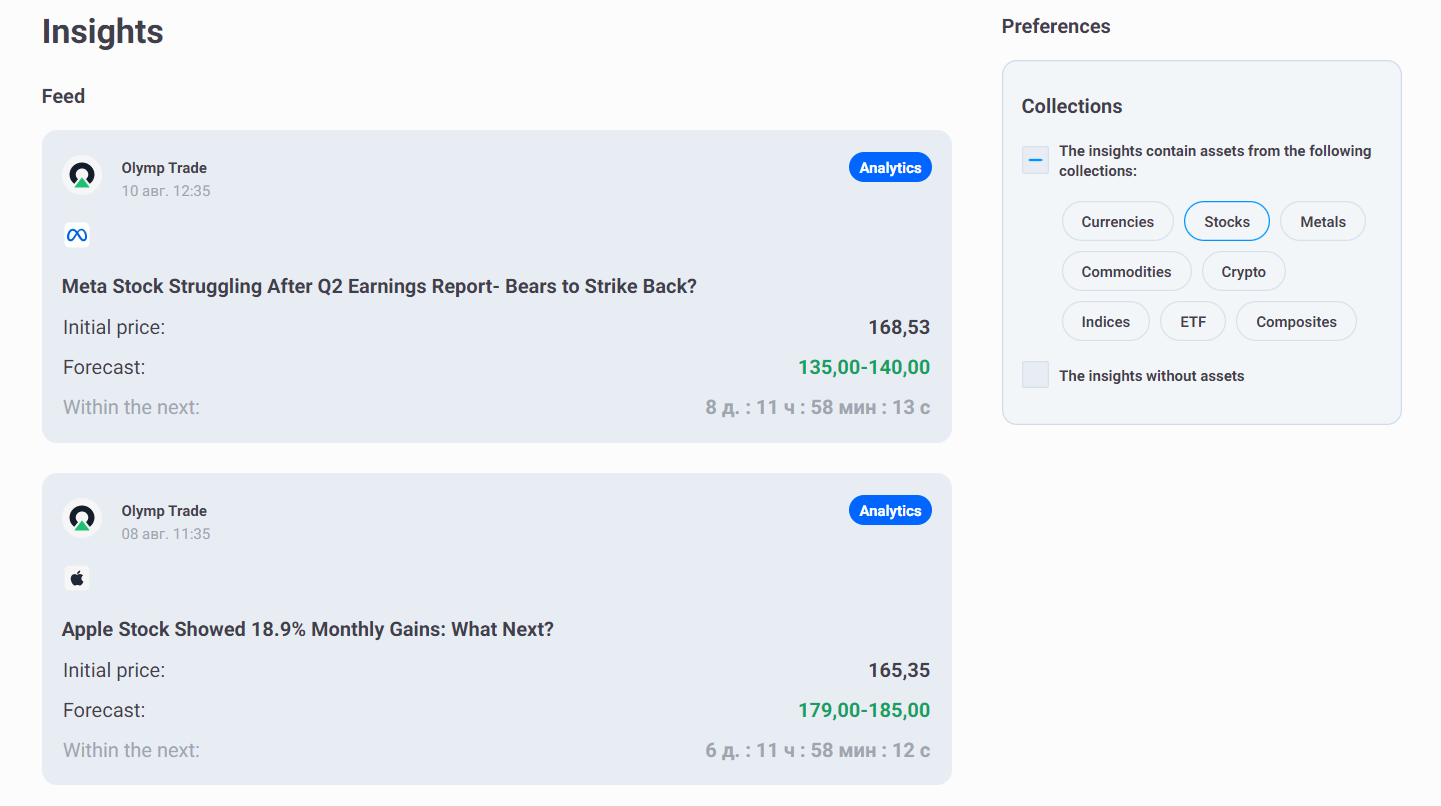

To help make investment decisions, Olymp Trade provides Insights in the form of fundamental analysis and analyst forecasts.

Portfolio Diversification 💼

If you distribute savings among assets, then your risks will be significantly reduced. The key idea of diversification is that you cannot invest in one stock or companies in the same sector.

It is best to distribute investments among several companies from different market segments. In this case, if one of the investor's stocks falls in price, others will most likely grow, and their profitability will eventually cover the losses incurred.

The risk of diversification is that, in rare cases, several sectors can suffer losses at the same time.

Risk Management Rules for Traders

Not only investors but also speculators should analyze market uncertainties. Without risk management, creating an effective trading system and determining the probability and magnitude of potential losses from trading is impossible.

Use Stop Loss and Take Profit ⛔

To reduce the risk of loss and protect trades, use Stop Loss and Take Profit. Thus, you can reduce the risk by limiting losses to an acceptable level.

Trailing Stop Loss (TSL) is an updated Stop Loss with the ability to automatically track the price of an asset within a specific price range. Each of these tools is available to you on Olymp Trade in Forex trading mode. If you want to know more about these tools, read this article.

Technical Analysis: Chart Patterns and Indicators 📈

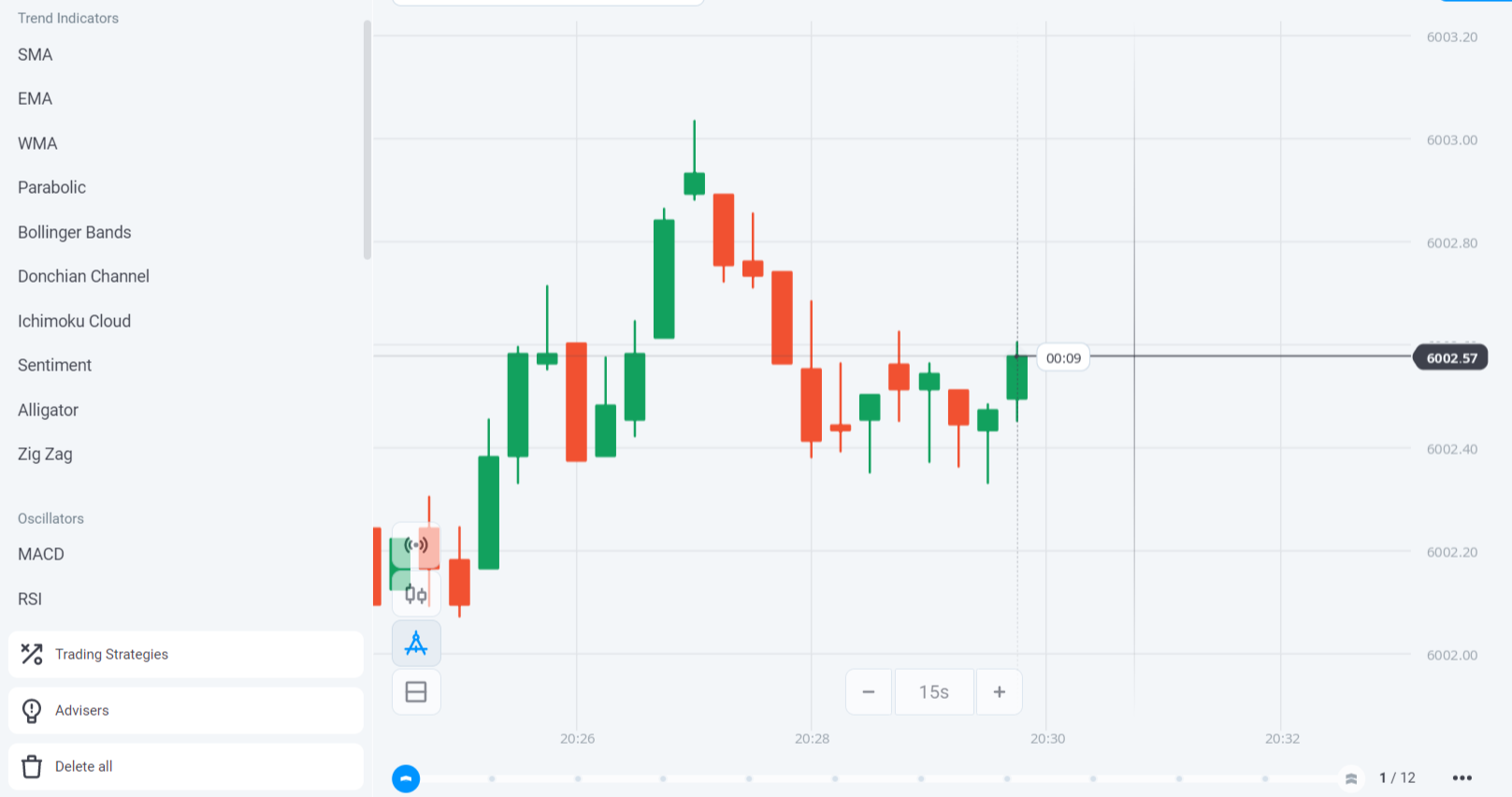

Technical analysis is a method of forecasting asset price changes based on price chart analysis. It is based on identifying patterns in the movement of the chart using special tools that are mathematical (indicators, oscillators, Fibonacci tools) and graphical (candlestick patterns, support and resistance levels, etc.).

Technical analysis allows traders to forecast the trend's further movement and its reversal, and choose the best time to open and close trades.

For more information about the basics of technical analysis, you can read in a special section of the Olymp Trade blog and the Help Center of the Olymp Trade platform.

Trade with a Multiplier 💰

Trading leverage is a financial tool that allows you to increase the opportunities and profits of a trader. At Olymp Trade, leverage is referred to as a Multiplier. This is a tool that allows traders to access much larger trading amounts than they could get with their own funds. Thanks to the multiplier, the trader seeks to profit without risking the main part of their capital.

Be aware that in addition to the potential profit size, the multiplier increases the level of risk.

However, regardless of the size of the multiplier, the potential loss will not be able to increase the amount invested in the trade. It is important to know that the Multiplier is only available in the Forex trading mode. Want to learn more about multipliers? Take a look at this excellent article about it.

Risk-Free on Olymp Trade 📍

As a reward for active trading and loyalty, Olymp Trade provides its traders with a premium Risk-free Trading feature. Such transactions are made in FTT mode and allows you to make transactions without risking your own funds. If your forecast is correct, you receive the profit. If not, the amount of the risk-free transaction is returned to the trader's account.

Important to know. If you have a $20 risk-free trade and invest $500 in a losing trade, only $20 will be returned to your account.

You have the possibility of risk-free transactions with the Expert status, by showing high activity on a real account, or by participating in tournaments.

General Rules of Risk Management

Regardless of whether you are a speculator or an investor, there are general rules for money management. These are simple but fundamental things that anyone who wants to trade effectively should consider.

Money Management 💸

Money management is the ability to allocate funds for investment in such a way as to minimize risks, preserve capital and increase it. It is an integral part of professional trading strategies. In addition, competent money management allows traders to stay in profit even in the presence of losing trades.

Set a daily trading limit and respect the risk per trade. Your limit is an insurmountable wall. For example, by setting a daily limit of 5% of your deposit, you should not exceed it.

Simply put, whether you are an investor or a speculator, money management for a trader is a set of clear rules that minimize the risk of drawdown and loss of a deposit.

In addition, we recommend using access to the records of your transactions. This useful tool will allow you to analyze your unsuccessful and successful trades and evaluate the performance of your trading portfolio.

Keep Emotions Under Control 👨💻

For a trader, it is important not to let emotions dominate common sense. The level of risk a trader takes on a trade has a direct impact on the emotional load. Less risk - trading will be calmer.

Anxiety, despair, euphoria, or overconfidence in market control is an undesirable phenomenon. Experienced traders are aware of the influence of emotions on the success of trading decisions and control them. Listen to your inner emotional state. If you are not ready to trade, then do not put pressure on yourself.

Understand the Market Trend 📉

You should not forget about trend Trend trading is a trading method that seeks to capture trending movements in the market using smart risk management. A trend includes a tendency for a price to rise or fall over a specified period of time.

However, there is also an opposite strategy. This is trading against the trend. It is when a trader seeks to profit from reversals against the prevailing trend.

Continuous Learning is the Engine of Successful Trading 📚

Trading in the stock market is nothing but a systematic approach where you need to pay close attention to risk management. Continuously learning to trade and invest is the only way to improve. Read the Education section of the Olymp Trade blog, learn from professionals, and develop with us.

Risk Management is Your Companion

Risk management in the stock market is one of the main components of successful trading. Trading stocks is a fairly risky activity if you disregard risk mitigation advice. Take the time to learn risk management tips and implement them into your trading strategy.

Develop your trading strategy on a demo account and join trading on a real Olymp Trade account.

Go to PlatformRisk warning: The contents of this article do not constitute investment advice, and you bear sole responsibility for your trading activity and/or trading results.

Mode of trading transactions for a limited period and receive a fixed income for a correct forecast of the movement of currencies, stocks, and other asset prices.

Intrinsic value measures the value of an investment based on its cash flow and shows the value of an asset based on an analysis of its actual financial performance.

It is a technical tool designed to help you minimize your risks on trades.

Take Profit is a postponed order that fixes your income on a trade at a specified level.

Fixed Time Trades (Fixed Time, FTT) is one of the trading modes available on the Olymp Trade platform. In this mode, you make trades for a limited period of time and receive a fixed rate of return for a correct forecast about the movements in currency, stock, and other asset prices.

A trend is the overall direction of a market or an asset's price.