The way you manage your personal finances may push you forward or set you back. To become more successful, start with adopting healthy money habits. They are no less important than eating a well-balanced diet and taking enough vitamin D.

In this article, we collected the best money management tips. They would work for people of all age groups, including college students, adults, and seniors.

Keep reading to see what you’ve been doing wrong and how to fix it.

#1: Face Your Debts

The first step to eliminating your debt is to confront it. You should be aware of the amount you owe. It’s scary, but ignoring the problem will get you nowhere.

Make a list of people and institutions you owe money to. Credit cards, consumer loans, individuals ー everything counts.

Then, calculate how much you should pay monthly to avoid penalties. It’s essential to cover at least minimum payments. Ideally, you should be able to pay a bigger percentage: offering no more than the minimum payment keeps you in debt for years.

If your cash flow is not enough to cope with the debts, change the behaviors that put you in debt and think of the ways to make extra money. Tone down your lifestyle, cut the credit card, find a better-paid job or alternative income streams.

#2: Determine Your Monthly Earnings

Many people are unaware of how much money they earn. It’s a big problem. To manage your cash flow efficiently, you need to know how big this flow is, where it originates, and where it goes to.

Sum up all the money you receive, including gigs, bonuses, dividends, ad revenues, trading profits, and other kinds of income, big and small. Don’t forget to take taxes out.

Now, you understand how much you earn. It’s time to see where this money goes.

#3: Healthy Money Habits

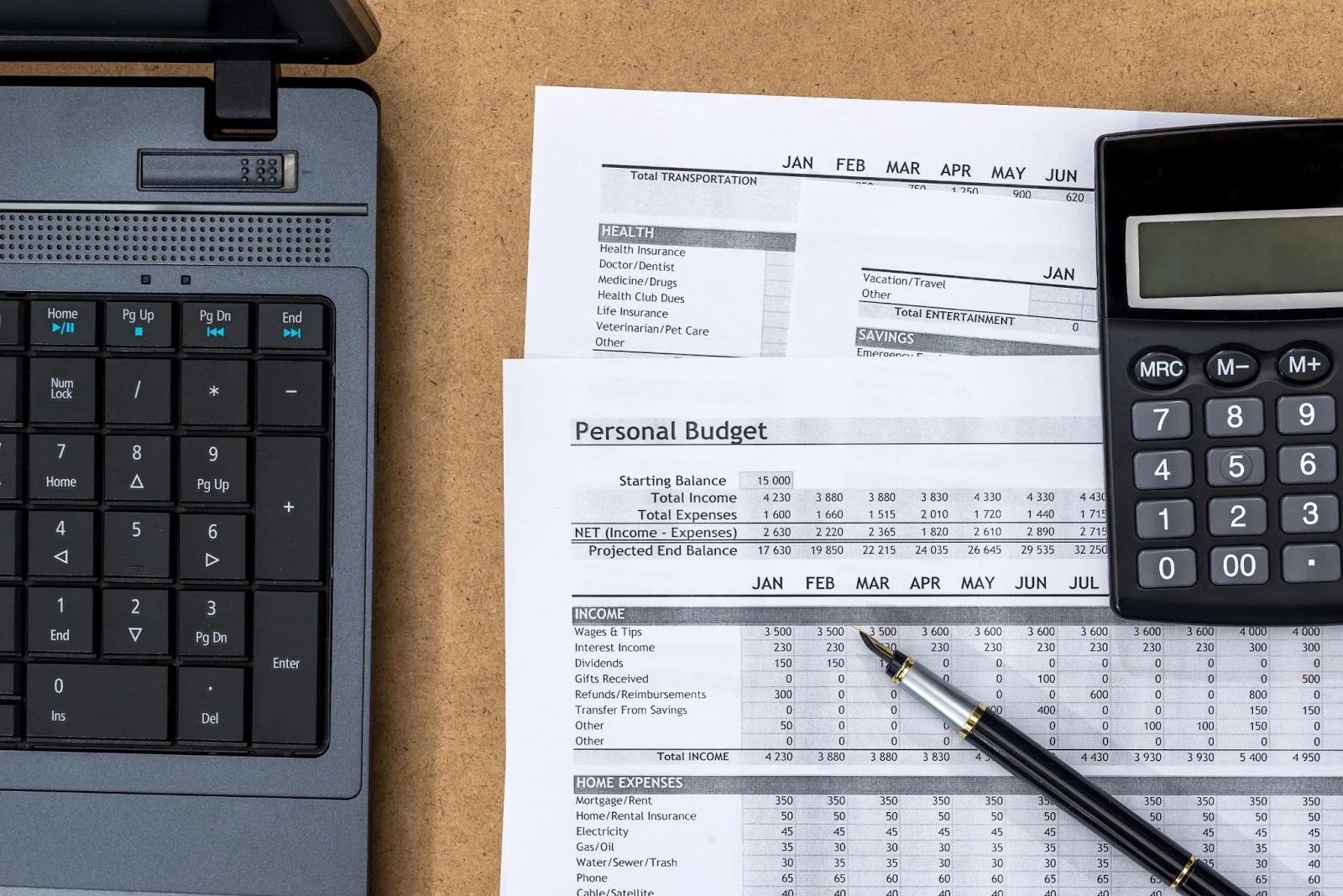

Tracking spendings is important to understand if you manage your money wisely. Many of us avoid budgeting as we see it as restricting and stressful. After all, this procedure makes us face our overspendings and give up the things we enjoy, doesn’t it? Besides, budgeting goes hand in hand with boring paperwork everyone hates.

If you share this vision, you need an attitude shift. You track spendings to reduce money waste, and not to deprive yourself of life’s greatest pleasures. By plugging the leaks, you channel more money to where you really want them.

#4: Harness Modern Technology

Speaking of calculations, there’s no need to use the pen-and-paper method anymore. Instead, take advantage of up-to-date budgeting software that offers a wealth of useful finance-tracking tools.

Today, there are tons of excellent money management apps for millenials. They make it easier to watch your investments, analyze your spending habits, and make smarter financial decisions. For example, some applications allow you to set weekly spending limits for different categories, automatically move extra funds to your emergency savings, or estimate the upcoming expenses.

The best apps are extremely user-friendly and have many settings to play with. It’s not always necessary to pay for premium add-ons, a free toolkit is often enough.

#5: Get Your Priorities & Goals Clear

A lot of money slips through your fingers just because you have no idea what your life goals and priorities are. Without a big picture, you may waste a lot of funds on useless stuff.

Again, goal-setting doesn’t mean bartering little joys against a greater good in the future. On the contrary, it lets you understand what is important and focus on it.

It may be a bigger house, a first-class education for your kids, a world tour, your own business, or early retirement, you name it. Once you have your goals crystal-clear, mindless spending will reduce automatically.

#6: Develop a Plan (and Stick to It)

Now that you know how much you earn and spend and what you’d like to achieve, it’s time to make a plan.

Making a plan means aligning your spendings with your goals and cutting out the stuff you don’t need. Say, if you are an ambitious designer, you may want to spend more money on a larger high-resolution monitor or best-in-class graphic software. Or, if you are a trader, you may want to invest in a faster laptop and an intensive trading course.

It’s up to you to decide what to cut out. You may save a lot of money by canceling or not prolonging subscriptions and memberships you never use, downgrading to economy-class flights, or using a train instead of a taxi.

#7: Start Saving Early

Saving early in life has a lot of advantages. If your money has a lot of time for growing, you can enjoy the benefits of compound interest.

Start small. Make it a habit to put aside X dollars every month when you get your paycheck. Soon, you will be doing it automatically.

Another trick is to have a clear goal in mind (See No. 4). It’s not enough to make a wish list. Visualize your goal in detail, charge it with emotions, get immersed in it. Thus, you will get emotionally connected to your future.

#8: Have an Emergency Fund

Always have an emergency fund. It would be worth at least 4 months of your must-do expenses, including rent, food, utility bills, transportation costs, etc.

Many people don’t save for a rainy day: some say the rainy day is now, others rely on their credit card or easily accessible loans. But you are smarter than that.

Having an emergency fund keeps you calm. When you don’t have any savings, immediate survival becomes your top priority in a difficult situation. It leads to bad financial decisions that will cost you dear.

To start making an emergency fund, reconsider your budget and sacrifice some things you can do without. For instance, if you cannot travel right now, put this travel money aside instead of buying a new TV.

#9: Look Out for Free Money

Find ways to pay less for the things you need or get them for free.

Today, we have a lot of saving opportunities we are not even aware of. Here are some wise tips:

- When shopping online, look for discounts, cashback, coupons, and special offers. Check the prices in other stores to be sure the original price sticker and the discount are real.

- Check if your employer covers the expenses like travel or life insurance, subscriptions to expensive services, educational courses, or gym memberships. Discover all the benefits of your jobー they may save you some hard-earned cash.

- Look for bonuses and promo codes to get what you want for less. Most of these offers are time-limited, so you’d better act fast and grab an opportunity before it expires.

- Claim what the government owes you. Sometimes there are tax benefits, credit help, and refunds people don’t claim just because they know nothing about them. If you feel you may be eligible for financial support, require the information.

#10: Make your funds work

As we know, inflation will eat away at your holdings over time, even if you deal with a relatively stable currency like the USD. So, don’t let all your money sit around in your savings account with its moderate interest rates. Instead, use a part of your funds to generate more money for you.

There are 2 ways you can make your “active money” work:

- Investing

You buy some asset and hold it till the price increases. The process may take months, years, or even decades, so the asset should match your goal and investment horizon. - Trading

In this case, you don’t get involved in a long-term relationship with an asset. It doesn’t matter if its price goes up or down because you can capitalize on both movements. The clue is to master the necessary Technical Analysis tools and create a brokerage account.

Olymp Trade, one of the recognized market leaders, offers an intuitive beginner-friendly interface, a rich collection of tools, and a wide variety of assets, including traditional and digital currencies.

Bottom Line

If you still see money management as stressful and boring, it’s time to change the attitude.

Saving, budgeting, cutting expenses, planning purchases, investing, and trading can be really exciting and empowering. Just outsource complicated and time-consuming tasks to smart apps with a super-convenient customizable interface.

If you want to try trading, start with creating an account on Olymp Trade.