People often ask themselves the question: How do I trade on the financial market correctly? Is it worth buying cross-currency pairs, shares, or ETFs for a long period of time, or is it enough to keep them for just a couple of hours and sell them? We’ll try to answer this question in the following article.

Is it better to rent a car or buy it outright?

Imagine a situation where you are moving to another city. You bought a new house, moved your things, but now you have a new problem. How to get to work. Work is quite far from home, and public transport does not go there.

In addition, you like to travel, but you don’t like flying on planes. You have two options: you can buy a car for work and travel, or you can rent a car every day. You have to agree that both options have their advantages and disadvantages.

If you buy your own car:

- It’s expensive.

- You will have repair and insurance fees.

- It’s possible that you will be dissatisfied with the car and sell it, and the price of the sale will be lower than what you purchased it for.

On the other hand, you are likely to take care of your car and try to make sure it doesn’t break down. Besides, it can last for many years and even be inherited by your children if it’s a good car.

If you rent a car:

- You’ll have to pay every day for a car ride, and after a prolonged period, this may cost you more than buying your own car.

- If you, for example, may encounter problems, get into an accident, or the car breaks down due to your fault.

However, if you don’t like the car, you can switch it at any time for practically the same fee.

What is investing?

Investing and speculating is like choosing a car for work and travel. Investing is primarily a long-term commitment, just like buying your own car. This type of investment will require a relatively large amount of money.

To give you an example, if you decide to invest your money in stocks, Apple is currently worth about $133 per share, Amazon $3,400, and Tesla $680. Certainly, you can buy a single stock of one company, but then your risks of not being able to make money (getting into an accident with your own car) increases significantly.

To reduce these risks, you need to make a portfolio that includes various stocks, including the so-called security stocks, meaning stocks of companies or exchange-traded funds (ETFs) that rise when markets fall. It’s like buying car insurance.

Imagine that you are planning a trip in your personal car. Before you go on the road, you need to check your car, the oil level, tire pressure, and so forth. Therefore, you need to know at least a little bit about your car, so that the trip won’t end badly. Likewise, when investing, you have to understand how the company you are investing in functions to know what to anticipate from the price movement in the future

This type of analysis is called fundamental analysis, and it aims to predict long-term price behavior. Learning fundamental analysis is like learning to understand what’s going on with your car. In this case, the risks of unforeseen breakdowns are greatly reduced.

So, just like you should regularly take care of your car and take it to a repair shop so that it doesn’t break down unexpectedly, you also need to take care of your portfolio at all times. This means that you, the investor, must regularly monitor the investments and, if necessary, either add some stocks to the portfolio or, on the contrary, exclude them.

Just like a reliable car that is regularly taken care of, a stock portfolio can last for many years, bringing a steady income for the investor. For example, over the past five years, Apple stock has grown 376%, Amazon stock 940%, and Tesla stock almost 1500%.

Your children and grandchildren can even inherit a properly compiled portfolio.

What is speculation?

As for speculating, it is similar to renting a car. First of all, you don’t need a lot of money to speculate. In order to trade, you can use your broker’s funds in the form of leverage or multiplier that is provided.

For example, a multiplier of X500 increases the trade amount by 500 times, which means that if you open a trade with just $10 of your own funds, you can trade for $5,000. On the other hand, just like renting a car, you have to pay regular rent in the form of a commission. Due to frequent trading, in the long term, the commission can amount to a substantial amount.

You are unlikely to take a long trip in a rental car. However, you probably won’t need to think about the oil level and gasoline. You’ll be thinking about the route and the fastest way to get from point A to B. Likewise, when speculating, you don’t need to understand what is going on with the business or, for example, understand the country’s economy whose currency you are buying or selling.

All you need to do is predict the price movement for a short period of time. For this, you can use another type of analysis called technical analysis. This type of analysis evaluates the chart and price movement itself. Technical analysis can quite successfully predict future price movement and behavior for different assets or financial instruments.

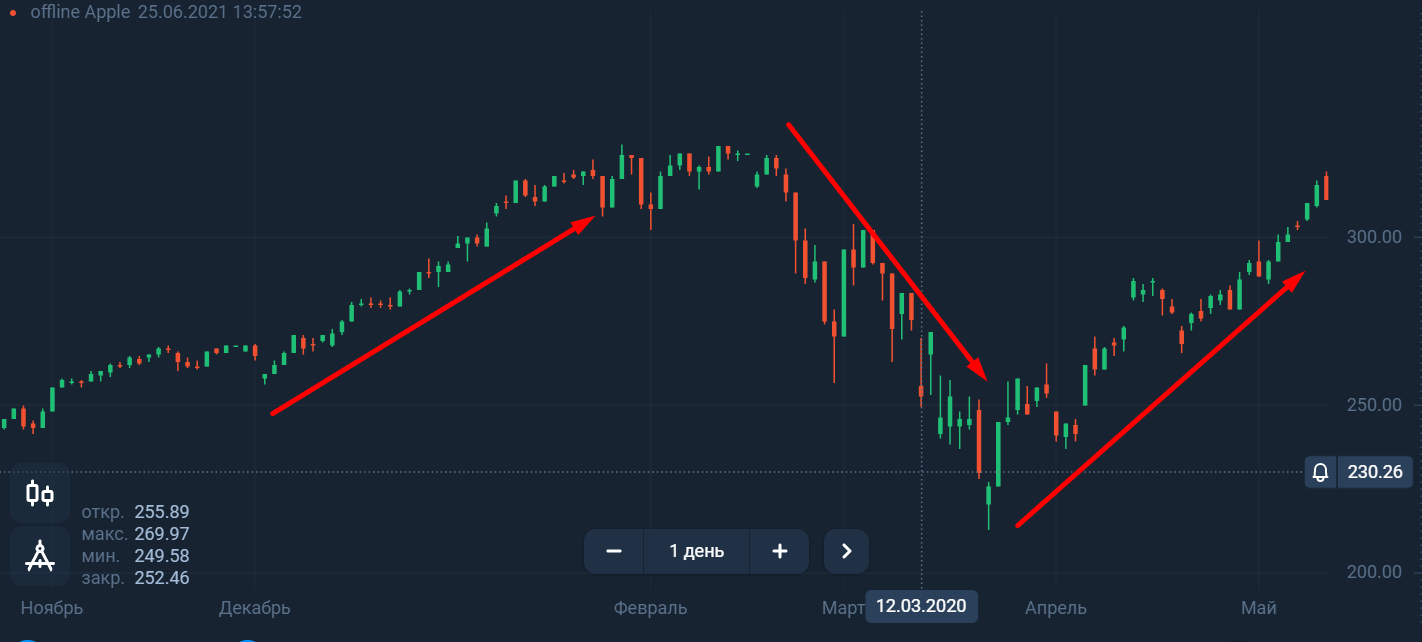

Unlike investing, where you often have to wait a significant amount of time to get a return, speculation allows you to get a profit in a fairly short period of time, and the trader often does not care where the price will go – up or down. It is only important to predict the short-term direction of the movement itself. For example, take a look at Apple shares. If you take a speculative approach, you can increase your income significantly by trading both up and down.

Like renting a car, where you can quickly exchange it for another, a trader can switch from trading certain assets to others. In this case, there is no need to regularly take care of the portfolio because this kind of portfolio most often does not exist or can be adjusted. Of course, with this approach, the risks increase significantly because of the number of trades.

Conclusion

The question is what to choose – an investment or speculative approach to trading? The truth, as always, is in the middle. To travel, it is better to have your car, but at the same time, no one forbids the use of rentals for occasional trips.

You can easily combine the two approaches, having your investment portfolio, which brings you profit in the long term. At the same time, a part of your money can be engaged in speculation, earning income on short-term market fluctuations.