The Moving Average is a very easy-to-use and popular indicator. Both beginner and experienced traders use it in a number of ways. Let’s see how it works.

Contents:

- What Is the Moving Average?

- What Are the Easiest Ways to Use the Moving Average Indicator?

- There Is More to Learn

Interact with the underlined words and green dots to get additional details and explanations.

Additional context for the visuals.

Explanations and definitions of terms.

What Is the Moving Average?

The Moving Average (MA) is a trend indicator. Unlike oscillators, it is used to forecast the price movement direction and charted on the same screen with the price performance.

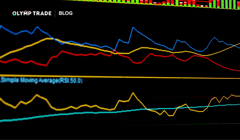

On the Olymp Trade platform, the first three indicators in the Trend Indicators section of Technical Analysis are the Moving Averages. These are the Simple Moving Average (SMA), Exponential Moving Average (EMA), and Weighted Moving Average (WMA) and reflect various ways how the average is calculated.

Three Moving Averages in the Indicators sidebar on the Olymp Trade platform

Generally, the value of the Moving Average indicator at a given point is calculated as the trading instrument’s average price across the chosen number of periods in that point. As the indicator’s value moves across time, it reflects how that average changes.

Therefore, the number of periods is key to the nature of this indicator. It may be set by selecting the pencil sign at the top-left corner of the chart that corresponds to the settings of the indicator.

You can access the settings of the indicator here.

If it is set to 10, the indicator will show the average price in the 10 periods at each step. If it is set to 200, it will calculate the average price every 200 periods.

What Are the Easiest Ways to Use the Moving Average Indicator?

Forecasting the Trend Direction

If the Moving Average rises, an uptrend may come, and it makes sense to open an Up trade.

If the Moving Average falls, a downtrend may form, and it makes sense to open a Down trade.

Market entry and exit points are best indicated in combination with other indicators used together with MA’s.

Identifying Trend Reversals

Here is the logic with one Moving Average:

If MA reverses upwards, and the price goes up, an uptrend may form.

If MA reverses downwards, and the price goes down, a downtrend may form.

Here is the logic while using two Moving Averages:

If a shorter period MA crosses the larger period upwards, an uptrend is coming.

If a shorter period MA crosses the larger period MA downwards, a downtrend is coming.

Using MA as Support and Resistance Levels

While Moving Averages set to any period can be taken as dynamic support and resistance levels, MA’s set to periods of 50, 100, and 200 are the most important.

There Is More to Learn

The Help Center is full of useful trading tips including other indicators.

Help CenterOscillators are indicators charted on a separate screen that mostly show if the instrument price is in the overbought or oversold zone.

The simple moving average (SMA) is a technical analysis indicator that smooths out price data by creating a constantly updated average price.

EMA is a type of Weighted Moving Average that gives most importance to the recent data.

Weighted Moving Average puts more weight on recent data.

Support level is the line made by sevelal lows that “supports” the price against dropping.

Resistance level is the line made by several highs that “resists” the price on the way upwards.