Many traders are unfamiliar with the US Dollar Index chart (also knows as the DXY chart). However, it can be an extremely useful indicator and trading instrument. Let’s check it out and see how you can use it in trading.

Contents:

- General

- Finding the US Dollar Index on the Olymp Trade Platform

- Formula of the US Dollar Index

- History of Development

- Using the US Dollar Index in Trading

- Two Methods of Trading with the US Dollar Index

Interact with the underlined words and green dots to get additional details and explanations.

Additional context for the visuals.

Explanations and definitions of terms.

General

While the stock indices, such as S&P 500,

NASDAQ, and

Dow Jones, show how particular industries or the entire economy are doing, the

US Dollar Index does the same in relation to the foreign exchange market. It is an important tool to understand because USD is the world's reserve currency, and up to 90% of all Forex trading involves USD. Therefore, as the US dollar dynamics are highly impactful on the entire market, understanding them is necessary for profitable trading and effective risk management in Forex.

Essentially, the US Dollar Index is a measure of the strength of the US currency. It is based on a basket of foreign currencies whose value is compared to the value of the USD. As the strengthening or weakening of the US dollar frequently sets the Forex market in motion, professional traders follow its changes with this index.

Finding the US Dollar Index on the Olymp Trade Platform

On the platform, the US Dollar Index can be found in Fixed Time Trading mode in the Indices section.

Formula of the US Dollar Index

The US Dollar index is calculated as a weighted geometric mean of the currency basket that consist of the Euro (EUR), the Japanese yen (JPY), the British pound (GBP), the Canadian dollar (CAD), the Swedish krona (SEK), and the Swiss franc (CHF). These currencies correspond to the largest trade partners of the US. As the impact of each on the US economy has different intensity.

The weight of the currencies in the index is configured in the following proportion:

- EUR, 57.6%

- JPY, 13.6%

- GBP, 11.9%

- CAD, 9.1%

- SEK, 4.2%

- CHF, 3.6%

Therefore, below is the complete formula of the index 🔽

USDX = 50.14348112 × EURUSD-0.576 × USDJPY0.136 × GBPUSD-0.119 × USDCAD0.091 × USDSEK0.042 × USDCHF0.036

History of Development

JP Morgan created the US Dollar Index in March 1973. That was the year when the Bretton Woods agreement ended, and the USD was no longer pegged to the value of gold. As the gold standard was abolished, the global foreign exchange system shifted to floating exchange rates.

After the Smithsonian Agreement and the acceptance of the Jamaican system, the US Dollar Index was revised once again in 1999, with the introduction of EUR. Its formula was expanded to include 19 more Eurozone countries and nine more of those that use the EUR but are not Eurozone member states.

Using the US Dollar Index in Trading

Similar to investors’ use of stock market indices to assess the stock market, the US Dollar Index can be used to analyze the Forex market.

For example, if we trade USD pairs, such as EUR/USD,

GBP/USD,

USD/CHF, or others, the

Basic Dollar Index will be a useful tool to identify those pairs’ trends, levels, and movement potential.

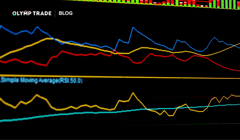

The US Dollar Index chart usually has positive correlation with the pairs where USD is the base currency, or when it is the first in the pair, like in USD/CAD or USD/CHF. That means, it moves in the same direction with them.

Below is an example of a positive correlation between USD/CAD and the

US Dollar Index.

Conversely, the US Dollar Index usually moves in the opposite direction with the pairs where the USD is the quote, or counter, currency. That is, it has a negative correlation with the currency pairs where the USD comes second.

EUR/USD has the greatest negative correlation with the

US Dollar Index because the weight of the EUR in the index is 57.6%. The below chart reflect that well.

Two Methods of Trading with the US Dollar Index

Method 1

The US Dollar Index movements may anticipate major pair’s moves.

For example, if the index breaks through an important support or resistance level or starts actively moving in any direction, there is a high probability that EUR/USD will soon do the same in the opposite direction if it hasn’t done so already.

Therefore, traders can use the lag between the currency pair and the index by observing the index first and opening trades with the EUR/USD before it actually moves in the expected direction.

Olymp Trade platforms’ Fixed Time trading mode and the Hourly time frame may be most suitable for that.

Method 2

The US Dollar Index may help identify trend lines and support and resistance levels.

We would open an Up trade with the EUR/USD if the US Dollar Index dropped touching the trendline or if it was near an important resistance level.

In the latter scenario, trend reversal chart formations or indicator readings would serve as an additional confirmation.

We would open a Down trade with the EUR/USD if the index went Up, reaching a trendline, or if it came close to an important support level.

Similarly, in the latter case, we would preferably need to have an additional confirmation with a reversal candlestick formation or indicator reading.

This method suggests using four-hour time frames or higher ones to analyze chart and find entry points. We recommend using a Daily time frame on the Forex trading mode.

While using the presented information in trading, remember that the US Dollar Index chart is primarily a macroeconomic tool useful to indicate the global state of the USD on high timeframes. It is best used in combination with other fundamental analysis tools.

Trade on the USD IndexRisk warning: The contents of this article do not constitute investment advice, and you bear sole responsibility for your trading activity and/or trading results.

Fixed Time Trades (Fixed Time, FTT) is one of the trading modes available on the Olymp Trade platform. In this mode, you make trades for a limited period of time and receive a fixed rate of return for a correct forecast about the movements in currency, stock and other asset prices.