The average daily range indicator is one of the best technical indicators on the financial market. It uses a unique calculation to detect market conditions and has become popular with short-term traders for its accuracy.

However, it would be unwise to start using the ICT ADR indicator for trading ideas without fully understanding what it means and how it’s calculated. In the following section, we describe the ADR calculator for Forex and effective methods to use this popular technical tool in short-term trading.

Contents:

- What is the ADR indicator?

- Using the ADR indicator in trading

- Using ADR to trade Up

- Using ADR to trade Down

- Practice makes perfect

Interact with the underlined words and green dots to get additional details and explanations.

Additional context for the visuals.

Explanations and definitions of terms.

What is the ADR indicator?

The ADR indicator is a technical indicator that helps financial investors measure an asset’s price volatility. The average daily range formula is not too complicated, as it calculates the difference between the asset’s high and low prices within a particular period and detects any significant change in the price action of an asset in the shorter term. With the ADR indicator’s unique calculation, there’s no wonder why this handy tool is a top choice for day traders.

Using the ADR indicator in trading

The ADR indicator is mostly an auxiliary indicator. It does not provide accurate signals to open Up or Down trades. When using the ADR calculator, Forex and stock traders can confirm whether to hold long positions or short positions on assets and sometimes to determine where to set Stop Loss and Take Profit levels. The ADR indicator, along with on-balance volume, open interest and the ZigZag indicator are widely used on the Olymp Trade platform. Like ADR, the Gator Oscillator and others share similar properties to auxiliary indicators.

To understand how ADR works for a trend, let’s first study its appearance 🔽

As seen above, the ADR indicator has charted a fairly normal line. It has peaks and dips whose depth depends on the distance between the highest highs and lowest lows in the selected time period.

There are three important observations to note before we move on to analyzing the indicator in relation to price:

- The indicator increases or decreases regardless of whether the price increases or decreases. If the indicator rises, then the trend is considered strong and trades should be opened within that trend. If it decreases, the trend is weak and trades should not be opened.

- The ADR indicator may lag significantly behind real time, so you should not rely on it completely.

- The ADR indicator should not be used during economic events or news events. The market’s volatility will be high, which means that the indicator is likely to give many false signals.

Using ADR for trading Up

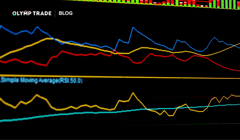

The EUR/USD currency pair experienced strong growth between 2005 and 2008. However, using the ADR indicator, this growth can be broken down into several sections:

In the highlighted section, the price of the asset is increasing, but at the same time, the ADR indicator is decreasing, which confirms either the weakness of the trend or a delay in the reversal of the indicator. In such a case, opening Up trades is not recommended.

The second section highlighted below is characterized by a growth in the ADR indicator, which means that you can open an Up trade until the indicator shows a reversal.

Indeed, if we had not used the ADR indicator, it would have allowed us to earn much more, but without it, the risks in such a position would have been greater.

It should be noted that we used long-term trends in this analysis. Now, let’s take a look at shorter timeframes.

Using ADR for trading Down

We can analyze how the indicator behaves using the same EUR/USD currency pair as an example. It is no secret that a strong bearish trend in EUR/USD began around May 2021. From March to April 2022, the ADR indicator reversed and began to decline. This was a signal for bears to lock in their profit.

As the ADR subsequently started rising again, this is a new signal to open Down trades.

Practice makes perfect

Now you know all the basics about the ADR indicator. Following the guidelines above will increase your profitability and reduce risks on capital — that isn’t to say, though, that you shouldn’t have a solid risk management plan in place nor keep an eye out for volatility. We suggest mastering these concepts via sufficient practice before applying them in live trades.

Join the Olymp Trade family, learn new concepts via the Olymp Trade Blog to add to your trading arsenal and become a force to be reckoned with on the markets!

Try ADR on a Demo AccountRisk warning: The contents of this article do not constitute investment advice, and you bear sole responsibility for your trading activity and/or trading results.

Refers to the purchase of an asset with the bullish expectation that it will increase in value.

Created when a trader sells an asset with the intention of repurchasing or covering it later at a lower price.

A postponed order that limits losses on a trade to a specified level.

A postponed order that fixes income on a trade at a specified level.

A technical trading momentum indicator that uses volume flow to predict changes in stock price.

The total number of outstanding derivative contracts, such as options or futures that have not yet been settled for an asset.

The overall direction of a market or an asset’s price.

Refers to the magnitude of change in an asset’s price.

A bear market happens when assets or major indices are falling in value.