The verification procedure includes 4 steps. We will provide you with instructions to follow.

Identity documents

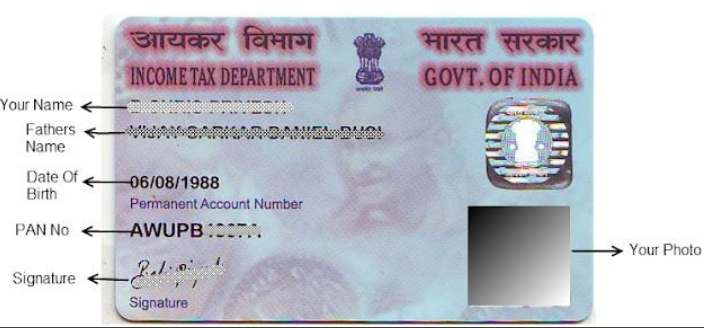

A client may submit one of the following documents:

- ID card

- Passport

- Driver’s license

- Aadhar card

- Voter Id card

- PAN card

The photo should be no more than 2 months old. The photo should be original, colour, and without any additional corrections. It should not be saved or edited in Photoshop.

Examples:

Selfie

Simply follow the instructions on the screen.

Proof of address

A client should provide one of the following documents:

- ID card if it was not provided as proof of identity. For example, if you have attached your ID card as proof of identity, you should send another document as a proof of address.

- Bank statement with client’s name and address visible on a single image, issued maximum 3 months ago.

- Utility bill with the client’s name and address issued maximum 3 months ago.

- Tax declaration with client’s name and address visible on a single image issued maximum 3 months ago.

- Student’s or working visa in another country.

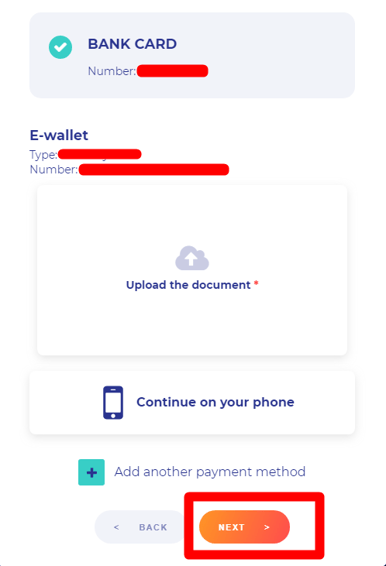

Proof of Payment

When uploading images for proof of payment, please note that each payment method needing confirmation should be uploaded to the corresponding section. For successful uploading, please do not create any sections on your own.

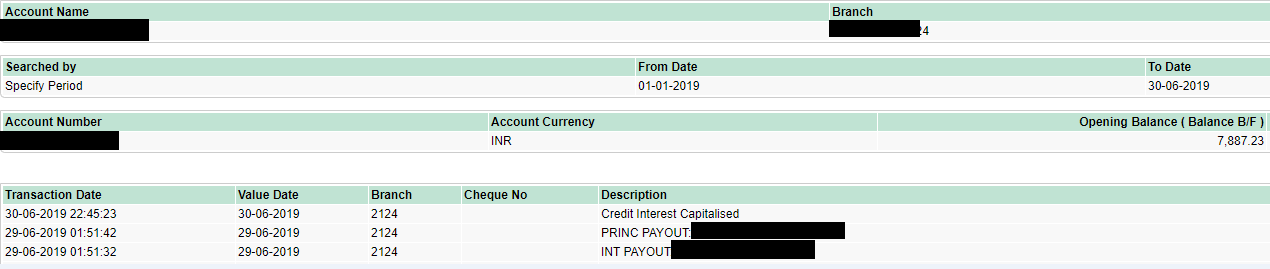

Online Banking

- To confirm this type of payment method, the client should submit a screenshot where the transaction to/from the platform and the owner’s name are both visible in one image.

- If it is not possible to submit just one screenshot, the client should send two screenshots:

- First with the owner’s name and account number.

- Second with the account number and the transaction to/from the platform.

- The screenshots should be relatable to one another.

- A photo of a bank book with the name and account number visible and screenshots from the online bank with the account number and transaction details visible.

Example:

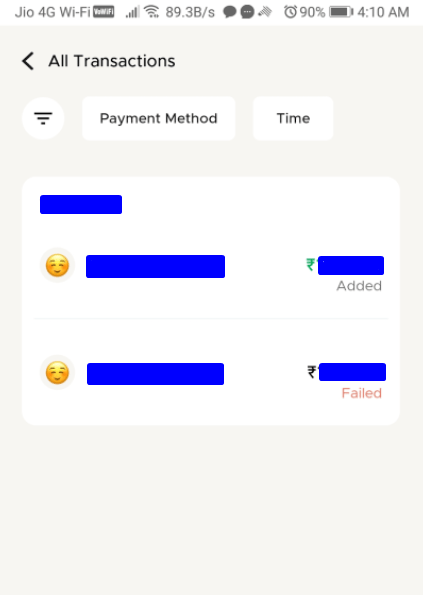

E-wallet

Before verifying the e-wallet used on the platform it should be verified by the e-wallet website.

- The client should send a screenshot with the transaction to/from the platform, the owner’s name, and the number of the e-wallet visible in one image.

- If this information is not visible in one screenshot, the client should send several screenshots. For example, one with the e-wallet number and the owner’s name, and the second with the e-wallet number and the transaction visible. The screenshots should be relatable to one another.

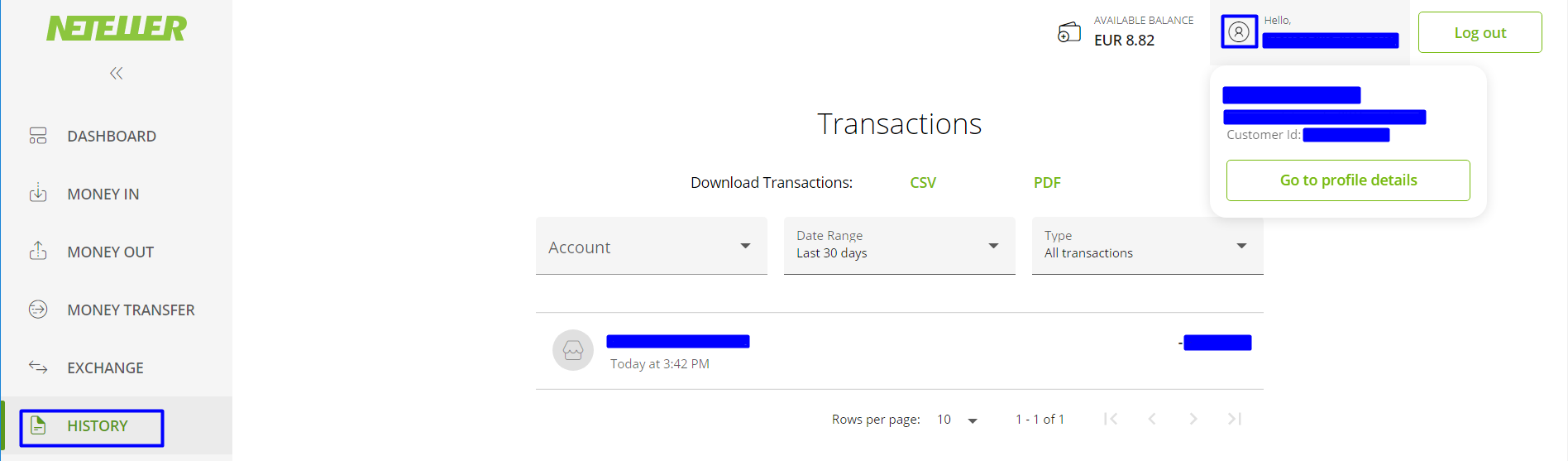

Neteller

Click “History” on the left to see the transaction history. If you have a lot of transactions on your Neteller account, choose the transaction type and date to narrow your search and then click Apply. After that, click on the human sign in the upper right corner. Ready! Make a screenshot of all of these pieces of information.

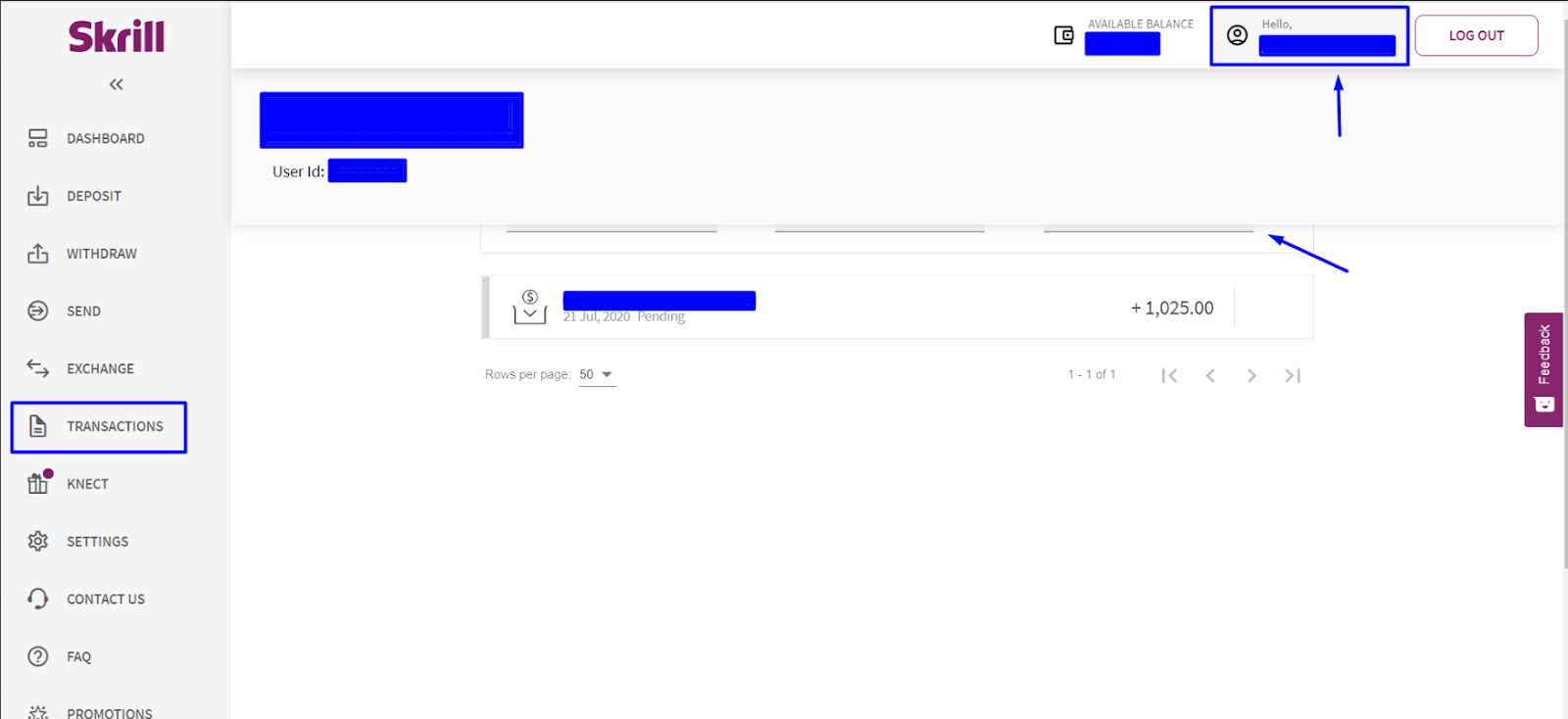

Skrill

Choose “Transactions” on the left-side menu and then choose the time period and transaction type. After that, click on the human sign in the upper right corner. A tab with the e-wallet owner name, e-mail, and user ID will be shown. Make a screenshot of all of these pieces of information. All the information should be visible in a single screenshot.

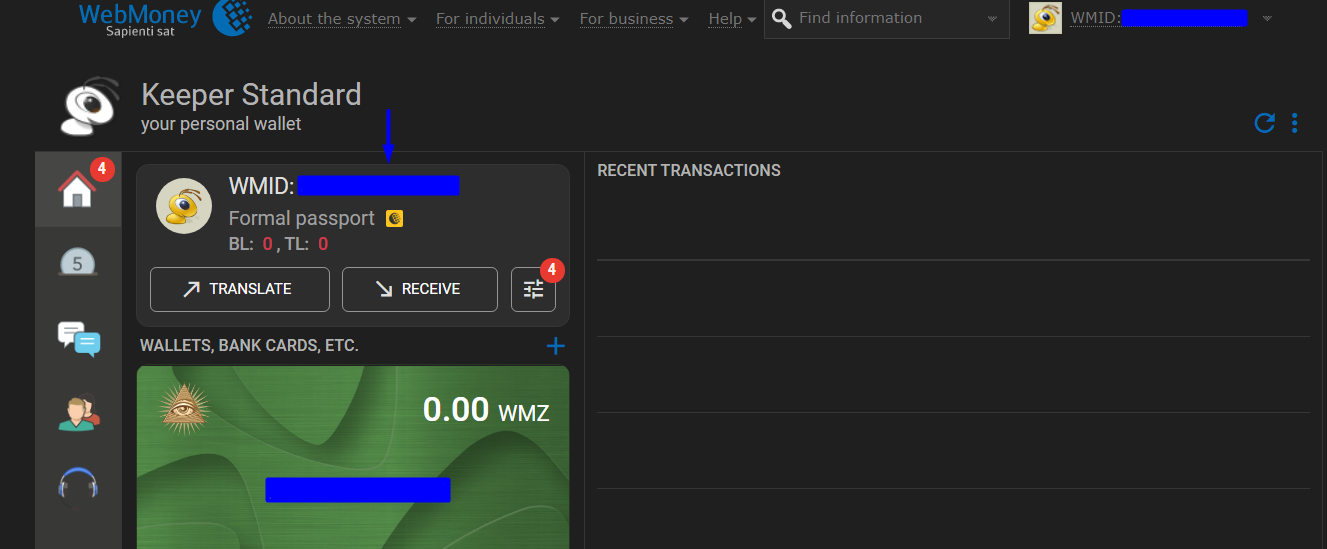

Webmoney

On the main page, please make a screenshot where the WMID, e-wallet number, and transaction amount and date would be seen altogether.

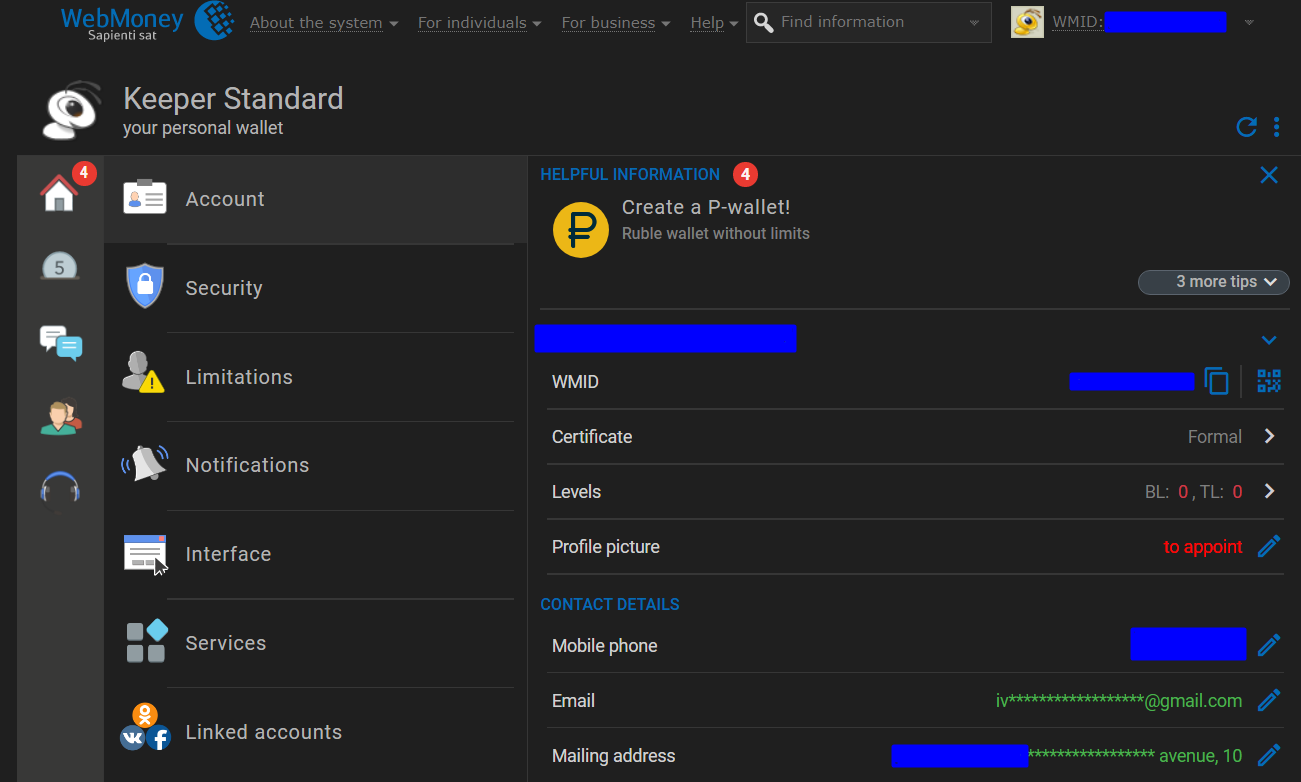

Then click WMID. Make a screenshot of the opened page.

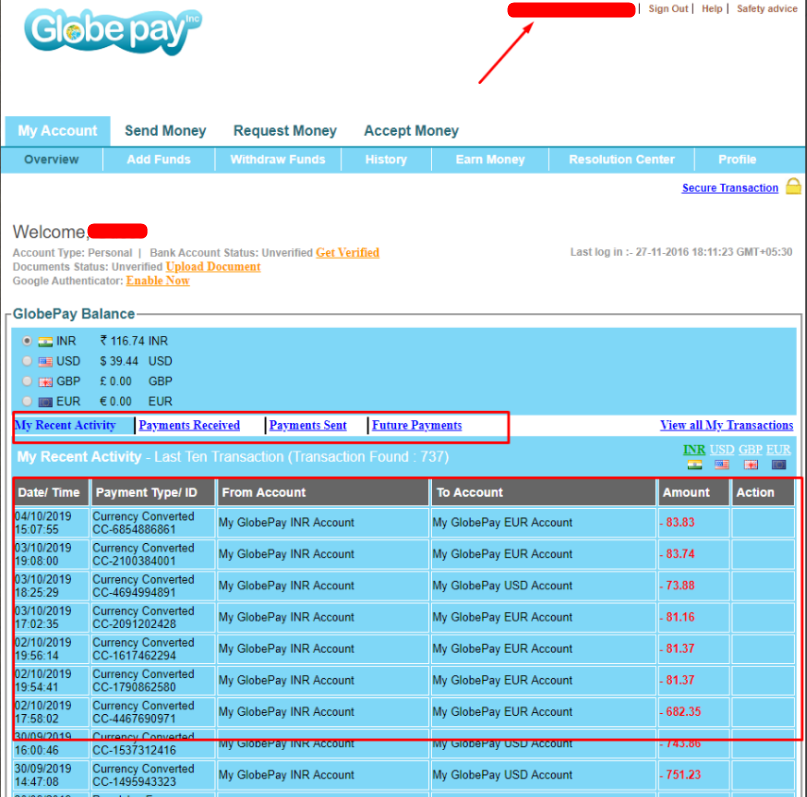

Globepay

For Globepay confirmation you must provide a screenshot from Globepay, with your personal information and transactions to your trading account.

UPI

For confirmation of UPI, a bank account linked to your UPI should be confirmed.

Please upload one of the following:

1) A bank statement with the owner’s name and transaction to the platform where all the information is visible in the same image.

2) A screenshot from UPI where the UPI ID, the owner’s name, and the bank account number are visible. In this case, a photo of the bank book with the bank account number and the owner’s name should also be sent.

3) A screenshot from UPI where the amount and date of the transaction and the bank account number are visible. In this case, a photo of the bank book with the bank account number and the owner’s name should also be sent.

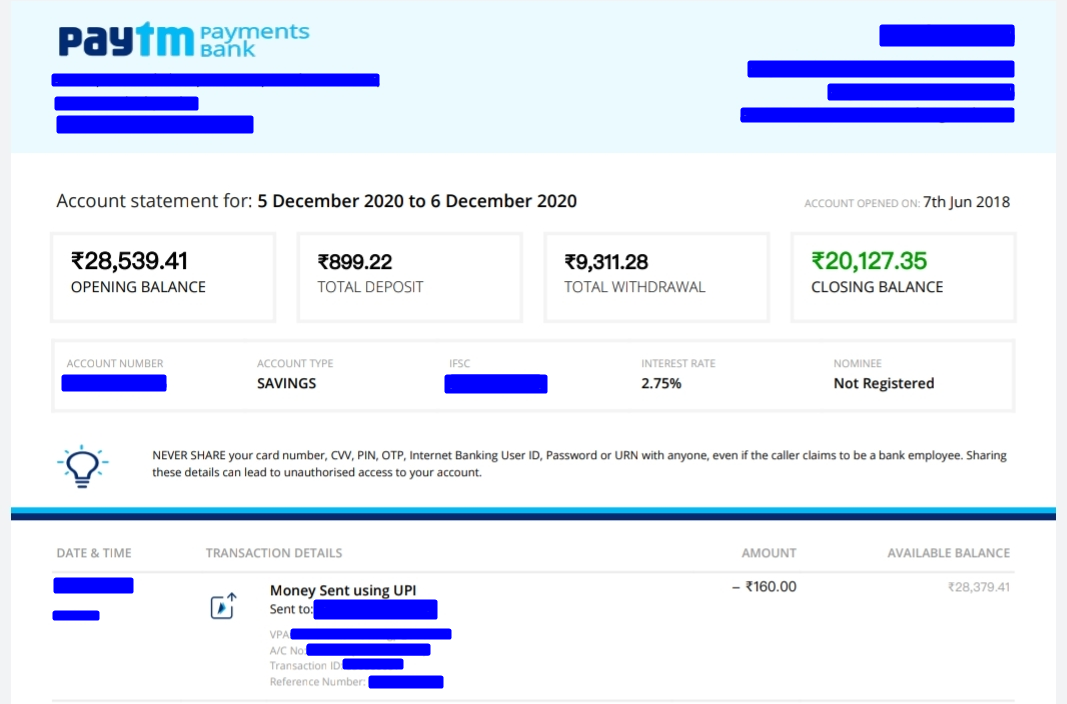

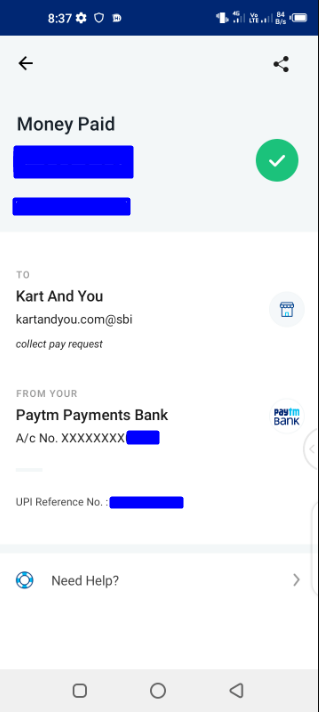

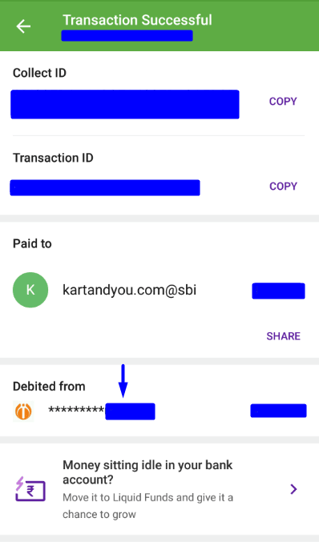

Examples:

A screenshot of the PayTM statement where the owner’s name and transaction details are visible.

If you provide a screenshot like the ones below, please attach a bank book that contains the bank account number linked to UPI as well:

\

\

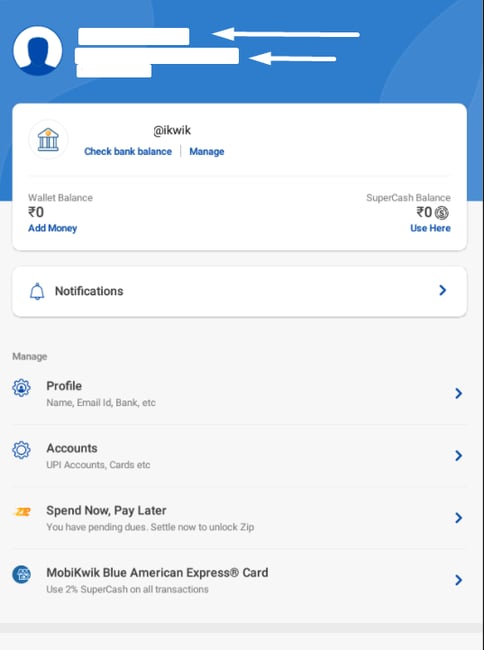

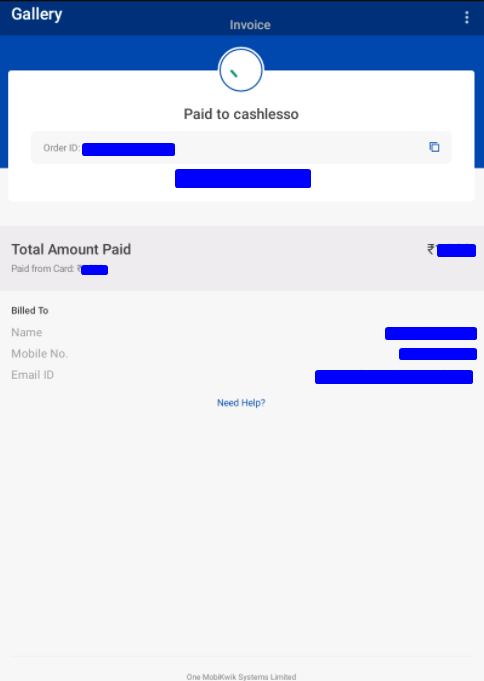

Mobikwik

Two screenshots are needed. The first with name and email, and the second with the transaction date, amount, and contact information.

Fampay

Upload a screenshot with the name, transaction date, and amount.

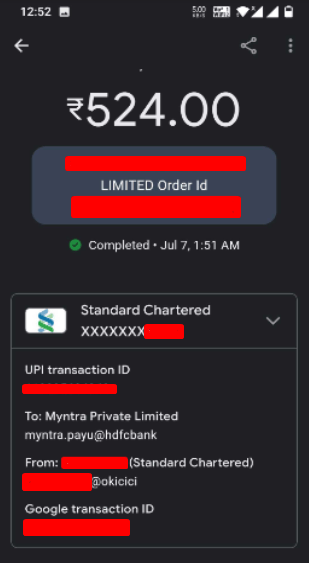

UPI GooglePay

Upload a screenshot where the UPI ID, the owner’s name, the transaction made to the platform, and the bank account number are visible.

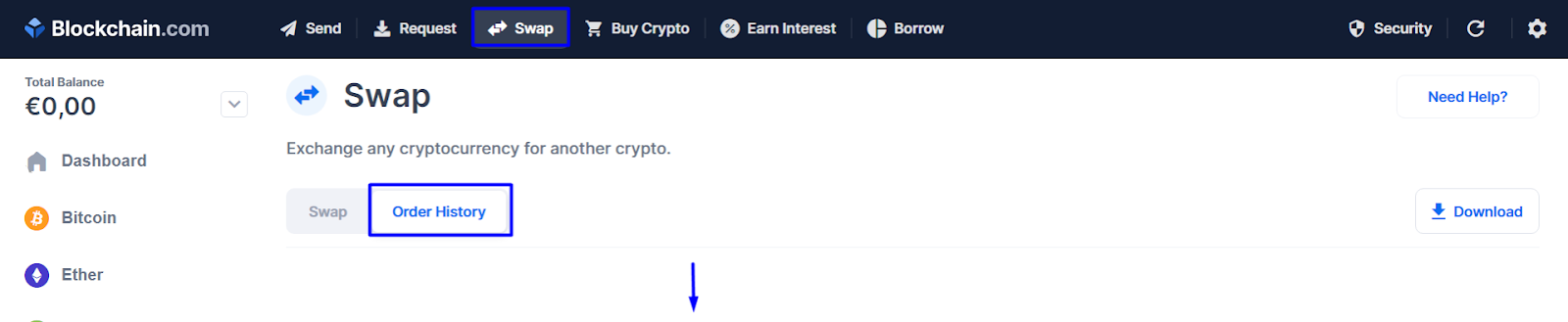

Bitcoin

Please provide a screenshot of transaction details (sum and date). Choose the order history in your e-wallet and make a screenshot of it.

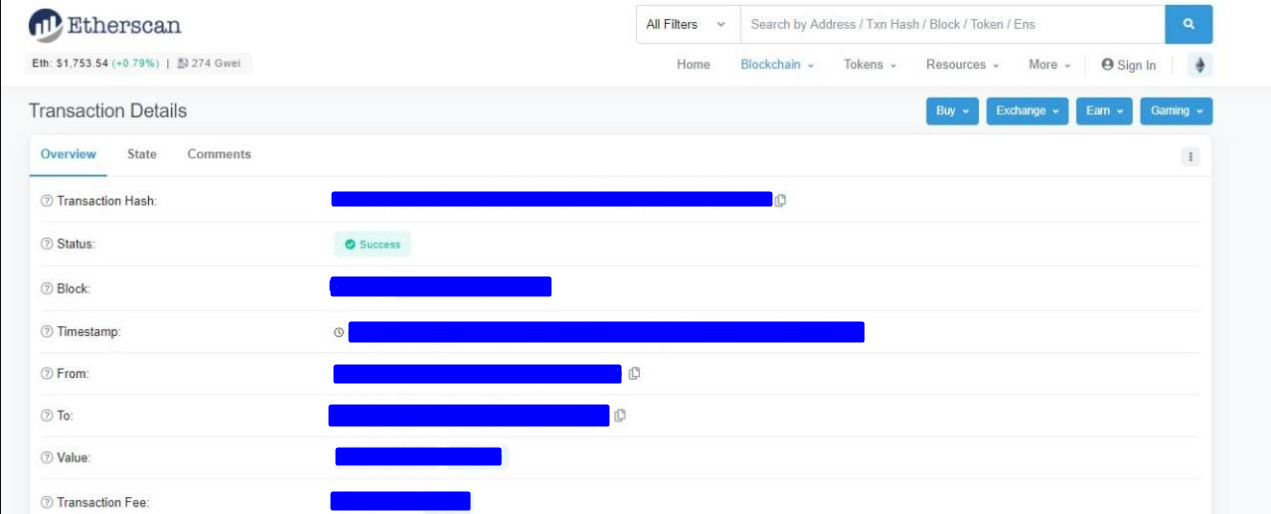

Tether/Ethereum

For confirmation of this e-wallet, a screenshot with the date and amount of transaction should be provided.

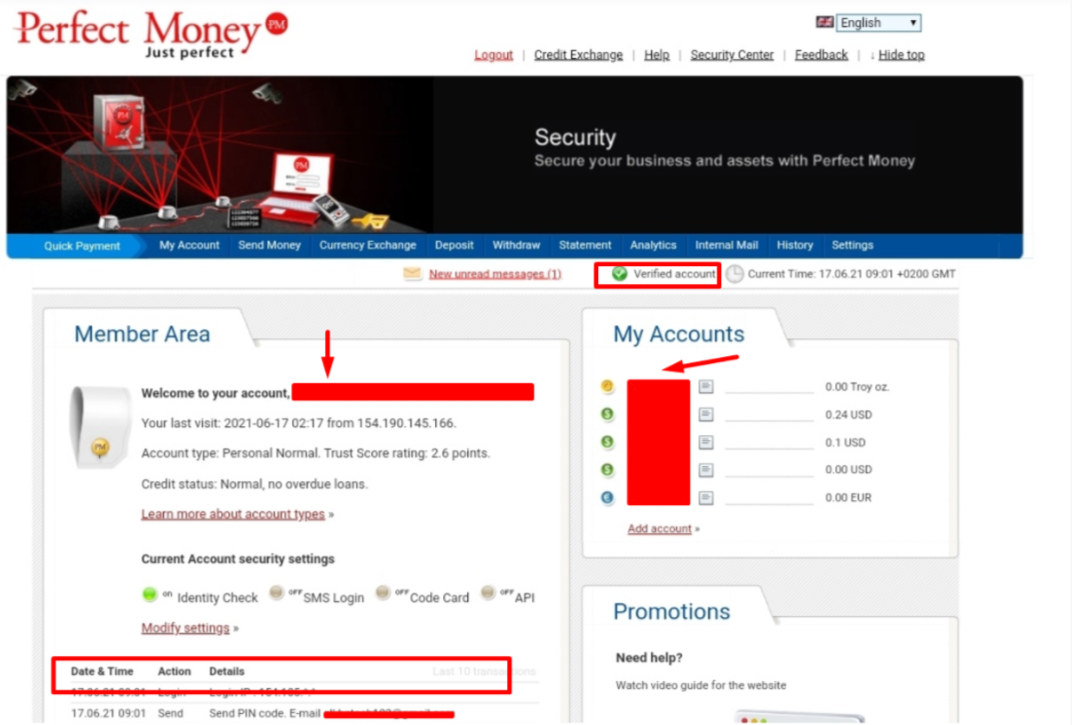

Perfect Money

For confirmation of your Perfect Money e-wallet, upload a screenshot with the owner’s name and account numbers. Make sure you have a verified account in Perfect Money.

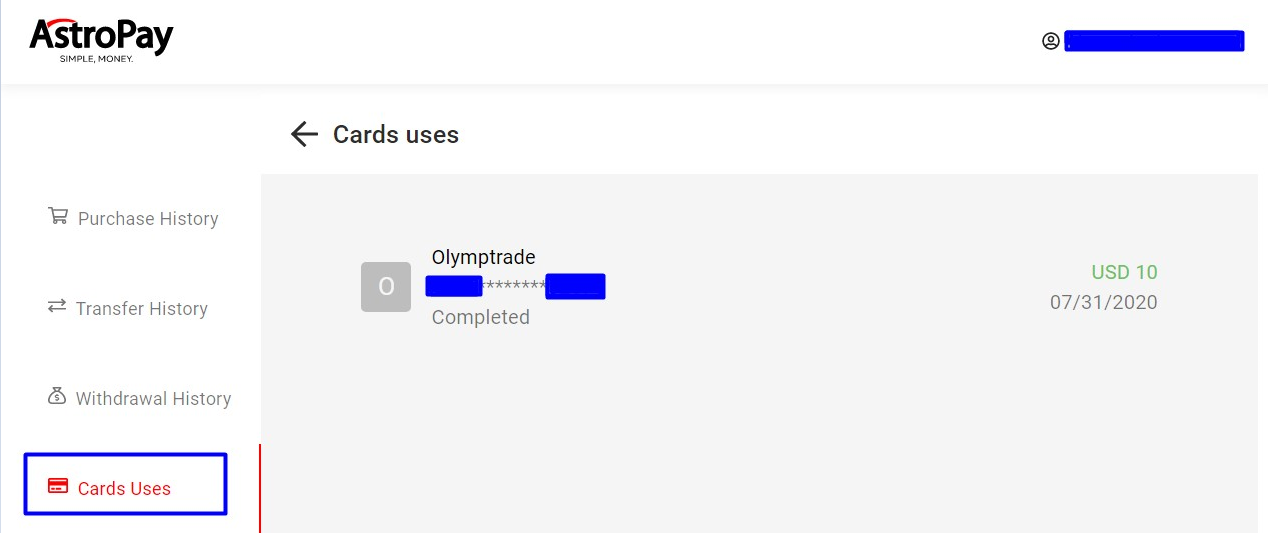

Astropay card

1. To confirm an Astropay Card, the customer should send a screenshot from their Astropay Card account. The account holder’s name and transaction details (sum and date) must both be visible in one image.

2. If a client claims that they can not provide a screenshot from point 1, let them send a screenshot from their bank account confirming these transactions. The name and the transactions must be visible in a single screenshot.

Example:

A client should open the “Card Uses” section and take a screenshot of this page if they deposited the whole sum of the card at once.

Bank Card

The instructions below are valid for Rupay cards as well.

1. The customer should provide a photo of their card. The back of the card is not required.

2. The first 6 and the last 4 digits, expiration date, and the owner’s name should be visible in a single photo.

3. Stolen/blocked card – a document certifying that it was issued to the customer.

4. If there is no document such as in point 3, a bank statement with the name and bank card number visible in a single photo or screenshot.

5. If there is no statement with the owner’s name and card number, let the customer provide one with his name and the transaction(s) to the platform. The sum, date, and the name should be visible in one image.

6. If nothing can be provided, please contact KYC.

Virtual Card

For confirmation of virtual cards, a statement with the owner’s name and transactions should be sent. All data should be visible in one image.

Confirmation of the Origin of Funds

In some cases, the Company may request a document that will confirm the source of funds.

Why is it requested?

- To protect our users from fraud.

- To comply with corresponding laws that allow us to operate as a financial company.

To confirm the legality of the funds, you will need to provide one of the following documents:

- an income statement for the past year

- a bank statement with an indication of the source of income

- an agreement for the sale of shares

- an agreement for the sale of property or a company

- a loan agreement

- a document that proves share ownership.

The document should contain your name.