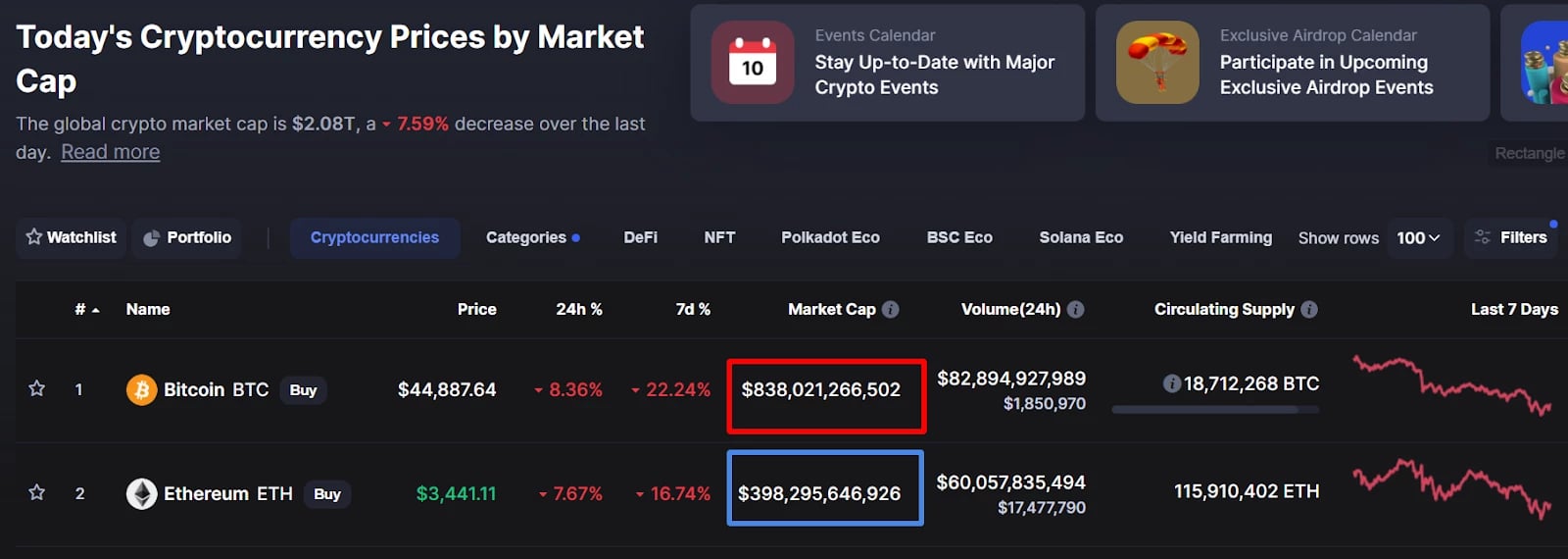

Ethereum is the world’s second-largest cryptocurrency, both by market cap and daily trading volume. Recently, this coin has been headline news due to its remarkable growth that helped some traders make significant profits.

Going to trade on ETH using the Olymp Trade platform? Read this article to know who created this coin, what is special about it, and why its price has gone through the roof.

Below are 6 Things you should know to understand Ethereum and assess its profit potential. Let’s start with the beginning.

#1: Who Is Vitalik Buterin?

Vitalik Buterin is a 27-year-old genius programmer of Russian descent who invented and co-founded Ethereum back in 2014. He became interested in crypto when he was a student and for some time worked as editor-in-chief of Bitcoin magazine.

At some point, Buterin started to explore alternative uses for BTC. He believed that blockchain, the underlying technology, had a great potential beyond money transfers. But Bitcoin developers didn’t no share this innovative vision.

Then, Vitalik teamed up with some other guys, including Joseph Lubin, Gavin Wood, Anthony Di Iorio, and Charles Hoskinson to launch his own crypto that would be bigger than payments.

In early May, Buterin was named one of the world’s youngest crypto billionaires when BTC surged wildly, and ETH followed the trend. He donated over $1 billion worth of different cryptos to India Covid Relief Fund. Vitalik also transferred millions of dollars to various tech-focused charities.

But, as it often happens in the world of crypto, the market dropped sharply in a day, making Vitalik leave the Billionaires Club. One of the drivers of this collective decline were Elon Musk’s famous comments about BTC and China’s restrictions on crypto use.

#2: How ETH Is Different from Bitcoin

Without going deep into technical details, Bitcoin developers offered a decentralized alternative to the traditional banking system that looked slow, insecure, and over-complicated. BTC was created for sending and receiving funds between 2 users ー in an easy, fast, safe, and global manner. In a way, you can see BTC as a decentralized version of EUR or USD.

The Ethereum blockchain serves for tokenizing and exchanging anything of value, including property ownership and author’s rights. To achieve it, the platform applies smart contracts, self-executing digital agreements between two peers. The in-house currency (ETH) is used to fuel transactions on the Ethereum platform or as a means of payment for different goods and services (if the service provider is ok with it).

To sum it up, ETH is younger, faster, and has a lot more use-cases in different sectors, including finance, insurance, gaming, healthcare, real-estate, and voting. Potentially, it can revolutionize the way people and businesses interact.

#3: ETH vs BTC: What Is Better?

It’s hard to say what is better because these two cryptos are different, each having its pros and cons.

Bitcoin is still the world’s biggest cryptocurrency, despite the recent price drops. It means BTC is a high-liquidity asset that can be easily bought or sold. Another BTC’s pro is the limited maximum supply that makes the coin immune to inflation. There will never be more than 21,000,000 BTC, and they are getting harder and harder to mine.

As for ETH, its maximum total supply is not limited by developers, though they promise the issuance of new coins will slow down with time. On the other hand, Ethereum is going to switch to a more environmentally-friendly mining mechanism called Proof-of-Stake. This switch is an important part of the Ethereum 2.0 road map.

Bitcoin is unlikely to move away from Proof-of-Work, an older method that wastes a lot of energy. Today, being green is essential for attracting and retaining big investors. Most crypto traders understood it from the recent incident with Elon Musk’s critical tweet that made BTC’s price plunge.

#4: What Ethereum 2.0 Means for Users & Investors

Ethereum 2.0 (Eth 2.0, Serenity) has been a buzzword for a while. It refers to a major upgrade that means fundamental changes in the network’s design. Ethereum 2.0 must be a solution to the platform’s main bottlenecks.

Long story short, the upgraded system is expected to be more scalable, secure, and sustainable. The complicated solution called “sharding” will enable the network to cope with increased workload (i.e., process more transactions per second).

The Proof-of-Stake (PoS) mining mechanism makes transaction validation a greener process. Instead of wasting a lot of electricity and expensive hardware, validators will have some of their ETH funds locked in the network. The bigger your stake (security deposit) is, the more “mining power” you possess.

It’s a good idea for ETH investors to keep a close eye on this road map. If everything goes as planned, it’s a good sign. Any big failure or delay may negatively affect the price of the coin.

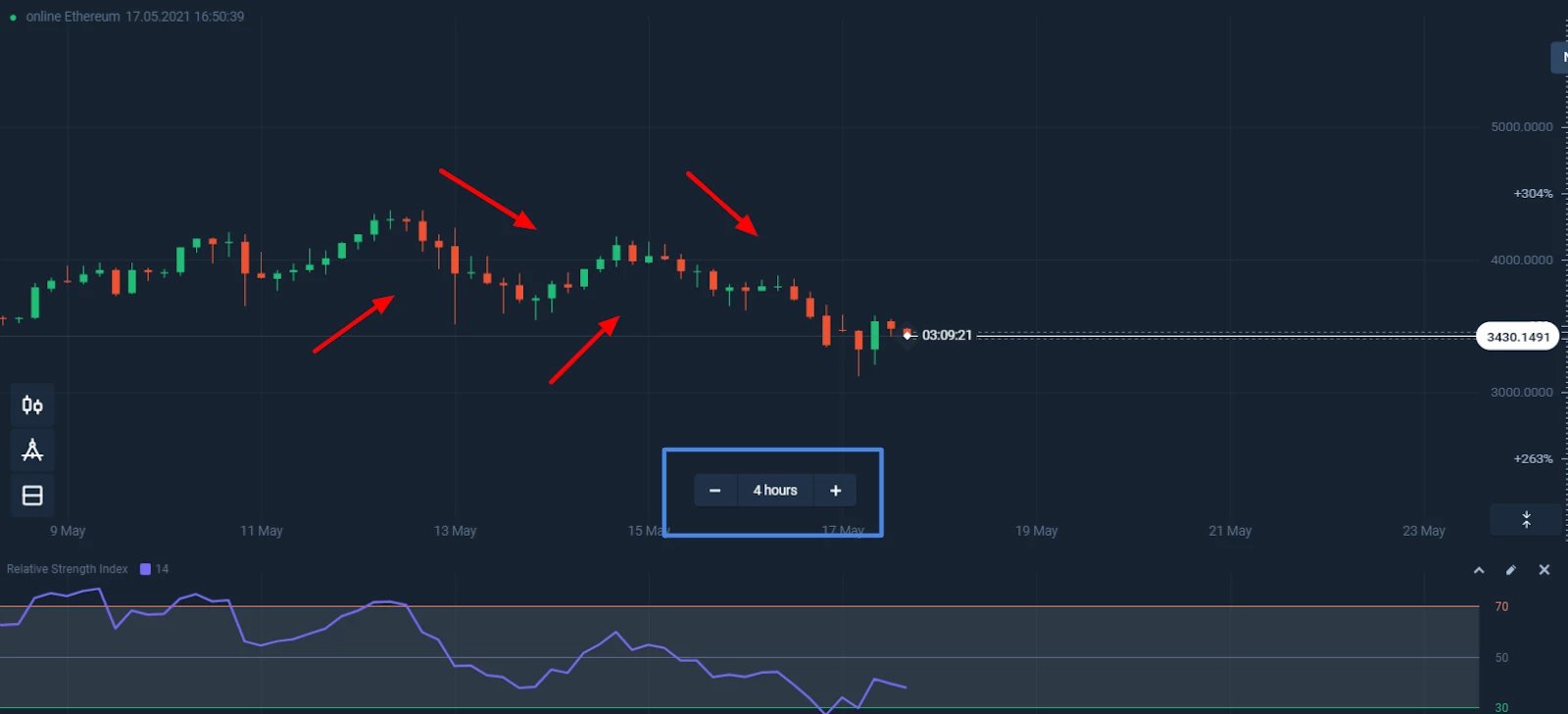

#5: Why ETH Skyrocketed Recently

The Ethereum market cap may soon reach half a trillion dollars. Over the past few weeks, the price of this crypto has been hitting new highs, making many traders and investors thrilled.

The main reason behind this surge is the growing interest in Decentralized Finance (DeFi) and Non-Fungible Tokens. Both innovations rely on Ethereum solutions like dApps (Decentralized Applications) and smart contracts.

Another big reason is the entry of institutional investors. A massive increase in capital inflow is always a good sign.

#6: Is ETH a Good Investment in 2021?

Though this impressive surge was followed by an unprecedented drop, we still believe Ethereum is a good asset both for holding and trading. After all, its price has been going up steadily since 2020, until it fell sharply during the recent crash, which spared no crypto.

There was excellent news adding to ETH value. On April 27, 2021, the European Investment Bank (EIB) issued digital bonds based on the Ethereum blockchain, with the support of Goldman Sachs, Santander, and Societe Generale. If the initiative is successful, others might follow the example. Vitalik Buterin is sure the time will come when ETH’s value and price stabilize, becoming less vulnerable to influencers’ tweets.

Until it happens, the first thing to keep in mind is that ETH is extremely volatile, like most popular cryptos. While this feature may scare away conservative investors, it offers many traders excellent buying and selling opportunities, especially if you have a high level of risk tolerance and can keep FOMO under control.

The crypto market is still rather small and sensitive, so you can expect higher than average profits on positive or negative news. Many seasoned traders had an excellent chance to capitalize on the recent price swings.

Go to the Olymp Trade platform to take advantage of Ethereum’s price swings. You can trade this crypto in FTT or Forex mode, depending on your preferences.