Trading charts help traders monitor the change in the value of assets, avoid losses, and make the right trading decisions. Each graph is an array of important information. Reading and analyzing this information correctly is an essential component of profitable trading.

Contents:

- Why Investors Should Know How to Read Stock Charts

- What Types of Charts Are There?

- How Technical Analysis Helps a Trader

- Graphical Analysis

- Mathematical Analysis

- Conclusion

Interact with the underlined words and green dots to get additional details and explanations.

Additional context for the visuals.

Explanations and definitions of terms.

Why Investors Should Know How to Read Stock Charts

Quote charts show an asset's current value and change over time. This allows you to find out the price of an asset at a given time and to study the general patterns of quote movement, predicting their direction.

The update rate depends on the platform's technical capabilities and the trading intensity in particular assets. On the Olymp Trade platform, as a rule, up to 4 quotes are displayed per second. A timeframe is a fixed time interval during which the movement of quotes is monitored.

For example, the Olymp Trade platform uses timeframes of 15 seconds, 1, 5, 15, 30 minutes, from 1 to 4 hours, 1 to 7 days, and one month.

By choosing a timeframe, you determine which quote movement trends you work with - short-term, medium-term, or long-term. On short timeframes, it is good to conduct short-term trading - scalping. Long timeframes - days, weeks, or months are more suitable for investing in slower growth. Timeframes with intervals of minutes and hours are more suitable for trading during the day - intraday trading.

What Types of Charts Are There?

There are several types of charts for tracking quotes. Here are the four most popular varieties and all of them are available on the Olymp Trade platform.

There are several types of charts for tracking quotes. Here are the four most popular varieties and all of them are available on the Olymp Trade platform.

Line Chart (Area Chart)

This is the easiest way. This is the most detailed chart showing fluctuations in the value of an asset. A line chart displays the price of a stock at the close of trading.

Candlestick Chart or Japanese candlesticks

This graph displays additional information about the value of assets. The trader sees the cost of closing, opening, and the maximum and minimum value of the asset price. Rising candles are in green while falling candles are in red.

A green candle indicates an uptrend when buyers push the price up. The lower border of the body reflects the opening price, the upper one - the closing price. The upper and lower shadows of the candlestick (wicks) show the highest and lowest asset prices within a given period. With red candles on the contrary, the upper border of the body reflects the opening price, the lower one - the closing price.

Heiken Ashi

It looks like an average Japanese candlestick chart, but it is an indicator. It simplifies trend analysis, thus helping to better determine the direction of the asset's price movement and the current trend's strength. It is achieved by averaging the opening and closing prices and the maximum and minimum quotes. Such a chart allows you to filter market noise and track trends more clearly.

Bar Chart

Even though this chart looks more complicated than Japanese candlesticks, it differs from them only in appearance. To determine changes in the price of an asset, you need to look at the horizontal lines on the sides, called "ears."

How Technical Analysis Helps a Trader

This is where technical analysis comes in. It is based on three postulates:

- The price takes into account everything. It is formed considering all the factors that can affect it (economic, political, psychological, etc.).

- The movement of quotes is within the framework of specific trends.

- History repeats itself. Based on the past movement of quotes, you can predict the future.

You can analyze and read stock charts in two main ways by using graphical or mathematical tools.

Graphical Analysis

This type of analysis involves drawing tools, such as those found on the Olymp Trade platform. With their help, you can build some important graphics yourself.

You can find drawing instruments right here.

You need to open Indicators tab here.

Trendline

Paying attention to the trend line, the investor determines whether the asset is growing or not. If the trend line has an upward trend, the trend is positive. If the line goes down, then the trend is negative. In rare cases, the trend line may look like a horizontal straight line.

Support and Resistance

These are the conditional boundaries of the asset's maximum and minimum price levels. The support level is at the bottom of the current price range, and the resistance level is at the top. Quotes may move within this corridor for some time, and this situation is sometimes called Flat.

Candlestick Patterns and Graphical Formations

These are technical analysis figures that can be plotted on a quote chart. Each pattern has its characteristics and can indicate the continuation of the trend and its reversal. The Doji, Three black crows, and Cloud patterns are good examples.

Graphic formation patterns such as the Head and Shoulders, Flag, and Double Top allow you to calculate longer-term trends.

You can read more about how to read stock chart patterns in this article on the Olymp Trade blog or in the Help Center.

As part of mathematical analysis, we have Fibonacci tools, indicators and oscillators.

Mathematical Analysis

More complex tools are also used when analyzing quotes based on complex mathematical calculations. Some examples of technical analysis tools are the Fibonacci levels and the Fibonacci fan. With their help, you can calculate the possible levels at which the current trend will accelerate or reverse. You can read more about this in a special article on our blog.

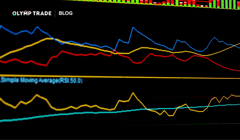

Indicators are another example of mathematical analysis tools. The Olymp Trade platform provides a wide selection of them and valuable tips on setting them up and using them.

You can find tools here.

To open tools tab tap here.

Other popular indicators include Simple Moving Average (SMA), Ichimoku Cloud, Alligator, Bollinger Bands, and others. These are trend indicators that show the movement of the trend and its possible reversal points.

A separate group of indicators is oscillators, which are helpful in situations where there is no clear trend. For example, the RSI assesses the level of overbought or oversold assets, which can be used to forecast the likelihood of an imminent change in price movement.

Another oscillator, Inversion Bollinger, was developed directly by an Olymp Trade analyst. It allows you to find the reversal points of the current trend with a high degree of accuracy.

Conclusion

The ability to read stock charts is one of the keys to successful trading. Of course, experience comes with practice. Everything depends on you.

A demo account on Olymp Trade is an excellent opportunity to hone your chart reading skills for free. Practice, trade, and improve your skills. The world of trading is open to you. The Olymp Trade team does everything the can to make your trading comfortable and efficient.

Risk warning: The contents of this article do not constitute investment advice, and you bear sole responsibility for your trading activity and/or trading results.